|

|

|

|||

|

|

|

|

| |

|

|

| |

| 글로벌 트렌드 | 내서재담기 |

|

|  |

이전부터 세계는 세계화와 탈세계화를 겪어 왔다. 지난 50여 년 동안 진행된 세계화는 시스템의 문제와 최근 코로나 19 대유행의 영향으로 탈세계화로 옮겨가고 있다. 미중 무역분쟁, 새로운 냉전의 시대로 대변되는 탈세계화의 시대, 위기와 기회는 어디에 있을까?

탈세계화는 국가들 간 상호 의존성과 통합을 감소시키는 과정이다. 이는 국가 간 경제 교역과 투자가 감소하는 시기의 역사를 의미한다. 특히 탈세계화와 세계화는 서로 반대되는 것이지만, 이 두 가지가 거울로 비치는 서로의 반대 상은 아니다. 역사를 통틀어, 상호 의존의 시기는 주기적으로 왔고 또 사라졌다.

그러나 1990년경부터 시작된 가장 최근의 상호 의존의 물결, 오늘날의 세계화는 역사상 유일하게 전 세계 인구 대부분에게 영향을 미쳤다. 지난 50년 동안, 특히 2000년에 중국이 WTO에 가입한 이래, 이번 세계화의 속도는 전례가 없었다. 그리고 주된 영향은 일부 국가들의 경제에 크게 집중되었지만, 그 여파는 전 세계 대부분의 사람들에게 퍼져 나갔다. 1970년 이래 전 세계적으로 세계화는 크게 50%까지 확대되었다. 그 결과 중국, 미국, 독일, 일본이 주도하는 교역에서 전례없는 급증세를 보였다. 이러한 교역 시스템의 증가는 자본, 인적 자원, 정보, 기술의 자유로운 흐름뿐만 아니라 실제 상품과 서비스의 교환에 대한 상호 의존성을 크게 높였다.

이러한 초연결성의 시대, 당연히 정치, 상업, 금융, 사회 분야의 전체에 있어 상호의존성을 폭발적으로 증가되었다.

.png)

코로나19 대유행 이전 약 30여 년 동안, 이러한 세계화의 물결은 중간소득(middle-income)과 고소득(high-income) 경제에 경제적 성장을 가속화했다. 그리고 전 세계적으로 극심한 빈곤에 대한 전례없는 수준의 감소를 이끌어냈다. 2019년 기준, 중국, 미국, 독일, 일본의 교역 활동이 전 세계 수출의 3분의 1을 차지한 점을 주목해보자. 이는 세계화가 이뤄진 경제에 대한 높은 의존성을 반영할뿐더러, 세계화의 반대 방향으로 나아간다는 것에는 큰 대가가 치러진다는 것을 의미한다.

그러나 세계화는 새로운 리스크도 가져왔다. 언제든 문제가 발생할 수 있는 취약한 공급체인이 그것이다. 즉, 이러한 취약성에 과도하게 의존했을 때, 위기가 발생하면 그만큼 큰 타격을 받게 된다. 일례로, 코로나19의 대유행에 맞서 전 세계가 바이러스와 총력전을 펼치면서 공급 체인에 충격적인 악화 현상이 일어났다.

최근 전 세계적인 탈세계화 움직임의 부상은 경제학자들이 ‘지역적인 부정적 외부 효과’라 부르는 것을 집중 조명하고 있다. ‘지역적인 부정적 외부 효과’는 세계적 규모에서 불충분하게 설계된 네트워크 구조로 인한 결과이다. 이는 다음과 같은 것들을 포함한다.

- 이민 쇼크에서 기인된 높은 사회적 스트레스

- 금융 침체기의 ‘경제적 전염’에 대한 리스크 증가

- 소득과 부의 불평등 증가

- 사회적 양극화

공유 네트워크에 대한 세계적 의존성은 문화와 경제가 성장할 수 있는 기회를 제공하지만, 해결되지 않은 갈등과 설계 오류가 사회 및 경제 시스템 전반에 전파될 때 의존성은 그 영향력을 더욱 악화시키는 것이다. 이것이 늘어난 상호의존성에 숨은 단점이다. 즉, 시스템이 연결되면 연결될수록, 오류와 예상치 못한 유해한 행동이 시스템 전체에 더 쉽게 전파될 수 있는 것이다.

상호의존성은 오류 전파를 위한 새로운 경로를 만들고, 빈도와 강도 양 측면에서 오작동을 일으킬 리스크를 더 크게 키울 수 있다. 이상 현상은 연속적으로 성장하거나 발생하진 않는다. 따라서 네트워크화된 전파 과정에서 임계 질량과 티핑 포인트가 존재함을 가정하면, 이들 규모는 전체가 폭발하는 상황으로 치달을 수 있는 것이다.

국가와 기업은 이러한 폭발에 대처할 수가 없다. 시스템의 실패를 분석하는 일은 전통적인 연구 방법의 역량에서 벗어나있기 때문이다. 전통적인 연구 방법은 오류를 고립된 형태로 분석하여 현실을 단순화할 뿐이다.

.png)

이러한 시스템화된 리스크가 더 명확해짐에 따라, 물류와 정보의 흐름이 변화하기 시작했다. 그리고 많은 국가들이 특정 유형의 제품에 대한 다른 국가에 대한 의존도를 낮추기 시작했다. 탈세계화의 움직임이 일어난 것이다. 실제로 미국과 일본은 제조업체가 특정 생산 능력을 자국이나 다른 지역으로 복원할 수 있도록 자금을 지원하고 있다. 그리고 이들은 일반적으로 기업들이 조달 프로세스에서 둘 이상의 공급 대체재를 확보할 것을 요구하고 있다.

이와 같이 탈세계화의 새로운 물결은 현재 어디까지 진행되고 있을까?

뱅크 오브 아메리카(Bank of America)와 메릴린치(Merrill Lynch)의 2020년 2월 보고서에 기술되었듯, 세계는 이미 코로나19 위기 이전에 세계화가 오랫동안 멈춰진 것을 목도하기 시작했다. 이것은 무엇을 의미할까? 전 세계가 공급망을 자국으로 가져오고 소비자에게 더 가깝게 움직이거나, 전략적 동맹국으로 방향을 재설정하는 전례없는 단계에 들어서고 있다는 것을 의미한다.

공급체인의 변화가 이뤄지는 최종 지역의 정부, 노동자, 사업자, 금융종사자, 소비자에게는 무수한 기회가 발생할 것이다. 또한 전 세계의 자동화 및 운송 기업들에게 이것이 미치는 영향력을 상당할 것이다.

.png)

90년대 이래로 공급체인은 저비용 및 수익극대화의 방향으로 꾸준히 발전해 왔다. 그러나 가장 최근의 변화는 질적으로 다른 4가지 요소로 이동하고 있다.

1. 뱅크 오브 아메리카의 연구에 따르면, 관세와 국가안보는 기업들이 가장 빈번하게 공급 체인 변화에 대해 이야기하는 주제이다. 최근 서명된 ‘미중 1단계 합의’와 같은 무역 협상이 결국 관세를 철회하더라도, 국가안보에 대한 우려는 가까운 미래에 더욱 강화될 것으로 예상된다.

2. 동남아시아와 인도가 변화하는 북미 및 아시아 공급체인 약 절반에 대한 최종 목적지가 되었다. 이는 남아시아 혹은 동남아시아의 매력적인 인건비로 인함이다. 이 매력적인 인건비는 이 지역의 낮은 생산성과 최적이 아닌 인프라를 상쇄하는 데 도움이 된다.

3. 변화하는 북미 공급체인의 또 다른 절반은 리쇼어링(해외에 나가 있는 자국기업들을 각종 세제 혜택과 규제 완화 등을 통해 자국으로 불러들이는 정책)으로 설계되었다. 이것은 에너지가 핵심 인풋(input)인 첨단 기술 분야와 산업에서 특히 그렇다. 이러한 의도는 수십 년 동안 진행된 북미 제조업을 황폐화한 트렌드의 첫 번째 반전을 나타낸다. 더불어 여러 아시아, 유럽 기업들이 상품을 고객 베이스에 더 가깝게 하려는 방식으로, 공급 체인의 최종 목적지로 북미로 언급하고 있다. 결과적으로 이는 운송비를 낮추고 리드 타임(lead time, 상품 생산 시작부터 완성까지 걸리는 시간)을 줄이고 있다.

4. 뱅크 오브 아메리카의 분석에 따르면, 3천 개 이상의 공공기업 중 92%가 새로운 공급 체인 하에 더 많은 자동화를 적극적으로 활용하려고 한다. 이는 북미와 아시아 기업들에게도 마찬가지이다. 그러나 유럽 기업들은 공급체인 전환과 관련된 마찰을 완화하는 방법으로 규제 변경, 세금 혜택, 보조금에 중점을 두고 있다.

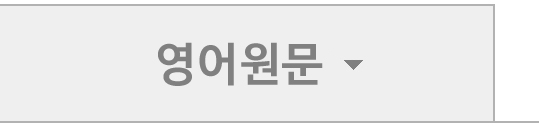

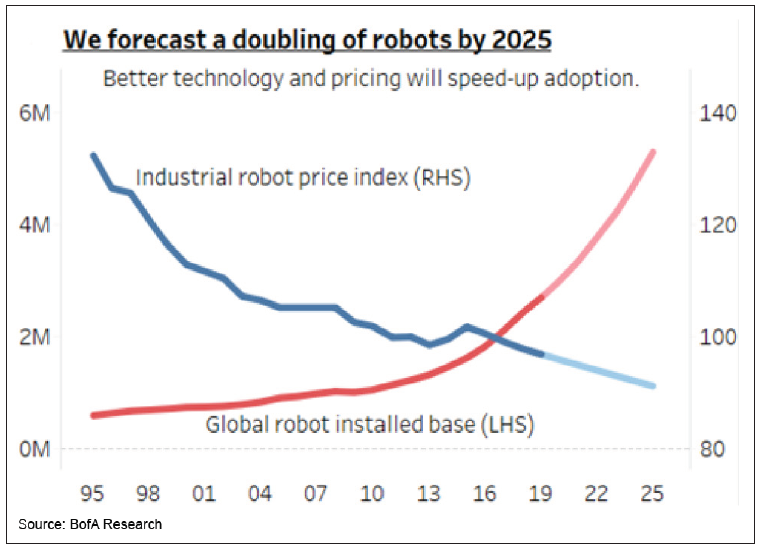

공급체인의 변화는 분명히 위험뿐만 아니라 기회를 창출한다. 낮은 인건비에 의존하는 개발도상국들은 혁신하거나, 자국 내 소비집단을 갖추거나, 혹은 선진국과 전략적으로 연계하지 않는 한 더 위험해질 수 있다. 북미, 동남아시아 및 남아시아와 같은, 공급 체인의 명확한 목적지는 자본 지출 증가, 일자리 창출, 임금 인상뿐만 아니라 제조업이 더 넓은 경제에 미치는 영향으로부터 이익을 얻을 수 있을 것이다.

코로나19로 더 거세진 탈세계화의 추세, 우리는 앞으로 다음과 같은 예측을 내려 본다.

첫째, 이러한 탈세계화의 시대는 기술경제 혁명의 마지막까지, 즉 2035년에서 2040년까지 지속될 것이다.

로봇공학, 인공지능, 생명공학, 나노기술은 더 많은 국가들이 탈세계화의 한계를 극복할 수 있도록 할 것이다. 탈세계화를 넘어 각 국가의 절대적인 물질 소비가 감소할 것이기 때문이다. 이러한 가치는 혁신과 고객 반응에 점점 더 의존할 것이다. 혁신의 창출, 보호, 라이센싱은 각 국가들에게 가장 중요한 핵심 역량이 될 것이다. 따라서 법을 준수하는 국가를 보호하기 위하여 그렇지 못한 국가들은 이 전체적인 흐름에서 분명 배제되는 현상이 일어날 것이다.

.png)

둘째, 오늘날 탈세계화의 가장 큰 수혜자는 미국이 될 확률이 높다. 반면 중국은 탈세계화가 진행될수록 많은 것을 잃을 수 있다.

북미는 에너지, 식품, 광물, 인적 자본, 금융 자본을 대부분 자급자족할 수 있다. 그러함에도 가장 역량있는 이민자를 계속 유치하고, 생산자와 소비자 네트워크에 대한 전략적 관계를 계속 유지할 것이다. 탈세계화에서 번영하려면, 수요와 공급의 두 가지 측면에서 상당한 임계 질량을 갖춰야 하는데, 이는 미국에게 유효한 것이다. 더군다나 1990년대 오프쇼어링을 야기한 과도한 규제를 가하는 정부와 전투적인 노동조합이 미국에는 더 이상 존재하지 않고 있다. 특히, 제조업 일자리 창출의 파급 효과가 상당하다는 점을 인식해야 한다. 예를 들어, 직접적인 제조업 일자리 하나가 경제 전반에 걸쳐 6개의 간접적인 일자리를 창출하고, 제조업 매출 1달러는 다른 경제 부문의 매출 1달러보다 GDP에 더 큰 영향을 미친다. 물론 제조업 파괴는 이와 반대의 파급 효과를 나타낸다. 중국은 자본, 에너지, 식량을 외부 세계에 의존하고, 성숙한 소비 경제를 온전히 갖추지 못했으며, OECD 국가들의 수준으로 지속적으로 혁신하는 능력을 입증하지 못한 상태에 있다. 따라서 다국적 공급 체인에서 분리되면, 성장에 큰 문제가 발생할 수 있다. 중국 인구의 급속한 고령화, 성비 불균형, 성장의 한계로 인해, 내부 불만이 사회적 긴장과 폭발로 이어질 수 있다.

셋째, 많은 개발도상국들이 새로운 트렌드에 참여하면서, 풍요로운 성장을 경험할 수 있다.

중국에서 빠져 나가는 제조 능력의 절반 이상이 남아시아와 동남아시아로 이동할 것이다. 다국적 기업들이 공급체인을 안전하고 다각화되도록 만듬으로써 필리핀, 인도네시아, 말레이시아, 태국, 베트남, 방글라데시, 인도 - 심지어는 미얀마도 ? 는 큰 수익을 얻을 수 있을 것이다. 파키스탄, 러시아, 이란, 여러 중앙아시아 공화국들은 아프리카의 비영리 국가들과 합류하여 중국이 주도하는 경제 블록에 참여할 가능성이 높다. 그러나 중국의 기존 경제 독트린을 고려하면, 이 동맹국들의 경제적 잠재력은 상당히 제한될 가능성이 크다. 미국과 마찬가지로 장기적으로 인도 또한 젊은 세대의 교육을 통해 큰 승자가 될 확률이 높다.

넷째, 인적 자본에 대한 제약을 보완하기 위해 북미는 유럽, 대만, 한국, 일본, 호주, 뉴질랜드와 마찬가지로 자동화에 중점을 둘 것이다.

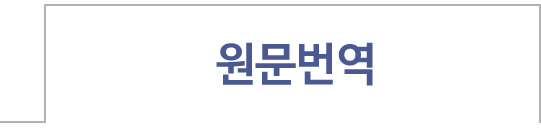

2020년 2월 뱅크 오브 아메리카와 메릴린치의 공장 자동화 지표(Factory Automation Indicator)는 코로나19 위기 이전에 이미 상승세를 보이고 있다. 뱅크 오브 아메리카는 “광학 감지, 머신 비전, 음성 인식, 환경 센서, 모션 액츄에이터 및 터치 햅틱 부문의 발전과 함께 더 개선된 컴퓨팅이 생산성 향상과 자동화의 새로운 가능성을 열어 가고 있다”고 분석했다. 뱅크 오브 아메리카는 2025년까지 전 세계에 설치될 산업용 로봇들을 500만대로 예상했다. 그러나 로봇 가격의 급격한 하락, 로봇의 유연성과 생산성의 증대를 고려하면 이 수치조차 상당히 보수적으로 접근한 것이다.

다섯째, 제조업체 및 산업 자동화 기업을 제외하고 공급 체인 변화의 가장 큰 수혜자는 북미, 동남아시아, 남아시아에서 강력한 위치를 점한 은행들이 될 것이다.

이들은 무역 금융, 운전 자본 대출, 외환 거래, 재무 서비스뿐만 아니라 중간 시장(middle market)과 거래 관리 서비스에 대한 기회가 대폭 증가함으로써 큰 이익을 얻을 것이다.

여섯째, 사실상의 새로운 냉전이 미국 주도 연합과 중국 주도 연합 사이에서 보다 강화될 수 있다.

이러한 대립에서 중요한 것은 ‘기술에 대한 철의 장막’으로 현재로서는 중국과 그 동맹국들에게 불리한 형국이 될 것이다. 이는 국제 무대에서의 역할을 약화시킬 수 있고, 앞으로도 주요 최신 과학 및 기술 공동체에서 중국과 그 동맹국들이 사전에 배제될 가능성을 높일 것이다.

* *

References List :

1. com. MAY 13, 2020. Chloe Taylor. Coronavirus will reverse globalization and create regional supply chains, economists predict.

https://www.cnbc.com/2020/05/13/coronavirus-will-undo-globalization-make-supply-chains-regional-eiu.html

2. The Review of International Organizations. January 28, 2019. Savina Gygli, et. al. The KOF Globalization Index ? Revisited.

https://link.springer.com/content/pdf/10.1007/s11558-019-09344-2.pdf

3. April 3, 2020. Kenneth Rapoza. The Post-Coronavirus World May Be The End Of Globalization.

https://www.forbes.com/sites/kenrapoza/2020/04/03/the-post-coronavirus-world-may-be-the-end-of-globalization/#18c1076f7e66

4. com. May 23, 2020. Jun Du, et. al. Coronavirus Won’t Kill Globalization ? But A Shakeup is Inevitable.

https://theconversation.com/coronavirus-wont-kill-globalisation-but-a-shakeup-is-inevitable-137847

5. com. Feb 28, 2020. HAROLD JAMES. A Pandemic of Deglobalization?

https://www.project-syndicate.org/commentary/covid-19-deglobalization-pandemic-by-harold-james-2020-02

6. BofA Global Research. February 7, 2020. Candace Browning Platt, et. al. Tectonic Shifts In Global Supply Chains.

https://www.bofaml.com/content/dam/boamlhttps://www.audiotech.com/trends-magazine/images/articles/2020/05/documents/articles/ID20_0147/Tectonic_Shifts_in_Global_Supply_Chains.pdf

7. The Star. March 2, 2020. Anthony Dass. The back door to deglobalization.

https://www.thestar.com.my/business/business-news/2020/03/02/back-door-to-deglobalisation

8. Palgrave Communications. 25 February 2020. Jose Balsa-Barreiro, Aymeric Vie, Alfredo J. Morales & Manuel Cebrian. Deglobalization in a hyper-connected world.

https://www.nature.com/articles/s41599-020-0403-x.pdf

9. Foreign Policy. APRIL 3, 2020. HENRY FARRELL. A Most Lonely Union: The EU is a creature of multilateralism. Can it survive in a deglobalized world?

https://foreignpolicy.com/2020/04/03/brexit-european-union-deglobalization/

10. com. 05 May 2020. Douglas Irwin. The pandemic adds momentum to the deglobalization trend.

https://voxeu.org/article/pandemic-adds-momentum-deglobalisation-trend

|  |

The Era of Deglobalization

Deglobalization is the process of diminishing interdependence and integration among nation-states. It describes periods of history when economic trade and investment between countries declines. Notably, while globalization and deglobalization are antitheses, they do not mirror images. Throughout history, periods of “interdependence have come and gone on a cyclical basis. However, only the most recent wave of interdependence, beginning around 1990, has involved a majority of the world’s population.

In the past 50 years, especially since China’s entry into the WTO in 2000, the speed of globalization has been unprecedented, and its primary impact has been concentrated largely in a few economies, even while touching most of the world’s people. Specifically, since 1970, there has been a worldwide increase in globalization of about 50%. And the result has been an unprecedented surge in a trade dominated by China, the United States, Germany, and Japan. The rise of this trading system has been highly dependent on the free flow of capital, human resources, information, and technology, as well as the actual exchange of goods and services.

This age of hyper-connectivity has led to an explosive increase in interdependence across the political, commercial, financial, and social spheres.

Over the 30 years prior to the COVID19 pandemic, this wave of globalization brought accelerated economic growth in both middle-income and high-income economies. And it contributed to an unprecedented decline in extreme poverty, worldwide.

Notably, as of 2019, the combined trading activity of China, the United States, Germany and Japan accounted for one-third of global exports. This reflects a high dependence on the globalized economy and implies that the economic transformation required by a reversal in globalization, will be major.

However, globalization also brought new risks to the world, including the risk of over-reliance on vulnerable supply chains. And these risks have been shockingly exacerbated by our efforts to fight against the pandemic.

The recent rise of deglobalization movements around the world highlights what economists call "local negative externalities" resulting from poorly designed network structures on a global scale. These include:

- high social stress derived from immigration shocks,

- elevated risk of "economic contagion" during financial downturns,

- increasing income and wealth inequality and

- social polarization.

While global dependency on shared networks enables opportunities for cultural and economic growth, it exacerbates the impact when unresolved conflicts and design errors propagate across social and economic systems. That’s because adding interdependencies has a hidden downside: The more connected a system is, the easier it is for errors and unexpected detrimental behaviors to propagate across the system.Interdependencies create new paths for error propagation and may escalate the risks of malfunctions in both frequency and severity. Anomalies do not grow or occur linearly. So, their magnitude may explode given the existence of critical masses and tipping points during networked propagation processes.

Countries and businesses cannot cope, because analyzing systemic failure exceeds traditional research methods that simplify reality by analyzing errors in isolation.

As these systemic risks have become clearer, logistics and information flows have begun to change. And many countries have started reducing reliance on other countries for certain types of products. In fact, the United States and Japan have specifically provided financing to assist their manufacturers in restoring certain production capabilities to their home countries or elsewhere. And they are typically demanding that companies ensure more than one supply alternative in their procurement processes.

That has already kick-started a new wave of deglobalization.

As explained in a February 2020 report from Bank of America/Merrill Lynch, the world had already started to see a protracted pause in globalization prior to the COVID19 crisis. What does this mean? The world has entered an unprecedented phase during which supply chains are being brought home, moved closer to consumers, or redirected to strategic allies.

Obviously, that creates myriad opportunities for the governments, workers, businesses, financiers, and consumers in geographies to which supply chains are being redirected as well as having profound implications for automation and transportation companies, worldwide.

Since the 90s, supply chains have steadily evolved in the direction of lower-costs and profit maximization. However, the most recent shifts appear qualitatively different due to four factors.

1. In the BofA study, tariffs and national security were the reasons companies most frequently cited for supply chain changes. And, even if trade negotiations, such as the recently signed “US-China Phase 1 deal,” eventually cause tariffs to be rolled back, concerns about national security are expected to intensify over the foreseeable future.

2. Southeast Asia and India were the planned destinations for about half of the relocated North American and Asian supply chains. This is a function of attractive labor costs in South & Southeast Asia, which helps offset lower labor productivity and sub-optimal infrastructure in those locations.

3. The other half of the relocated North American supply chains are designated to be “re-shored.” This is particularly true for high-tech sectors and industries for which energy is a key input. This intention, if borne out, would represent the first reversal in a multi-decade trend that has “hollowed out” North American manufacturing. Meanwhile, several Asian and European companies cited North America as an intended supply chain destination, primarily as a way to move production closer to the customer base. That, in turn, reduces shipping costs and lead times. And,

4. The BofA analysis revealed that 92% of over 3,000 public companies intended to use more automation in their new locations. This was equally true of North American and Asian companies. However, European companies also focused on regulatory changes, tax benefits, and subsidies, as ways to mitigate the friction associated with shifting their supply chains.

Obviously, shifting supply chains creates opportunities, as well as risks. Developing countries that depended on labor-cost differentials could be worse off unless they innovate, possess a large pool of domestic consumers, or are strategically aligned with developed markets. The apparent destinations for supply chains such as North America, Southeast Asia, and South Asia should benefit from increased capital spending, job creation, and higher wages, as well as manufacturing’s multiplier-effects on the broader economy.

Given this trend, we offer the following forecasts for your consideration.

First, prior experience implies that this era of deglobalization will last until the end of the Fifth Techno-Economic Revolution, between 2035 and 2040.

Robotics, AI, bioengineering, and nanotech will enable more nations to cross the “dematerialization frontier” beyond which a nation’s absolute consumption of materials diminishes. The value will increasingly depend on innovation and customer responsiveness. Creating, protecting, and licensing innovations will become the most critical core competency of a nation. So, those countries which flaunt the rule of law must be ostracized from the mainstream in order to protect the countries which play by the rules.

Second, as previously forecast in RIDE THE WAVE, North America will be the big beneficiary of deglobalization, while China will be the big loser.

Why? North America is largely self-sufficient in terms of energy, food, minerals, talent, and capital. Yet will strive to attract the most talented immigrants and maintain strategic relationships with a network of like-minded producers and consumers. However, only North America has a critical mass in terms of both supply and demand to thrive in a deglobalized world. And that’s especially true now that the excessive regulatory regime and militant labor unions that encouraged offshoring in the 90s are in decline. That means that the “ripple effect” of creating manufacturing jobs will be enormous; for instance, each new direct job in manufacturing creates 6 indirect jobs across the economy, and a dollar of manufacturing sales has a greater impact on GDP than a dollar of sales in any other sector of the economy. - Meanwhile, destroying manufacturing jobs has a similar ripple-effect in reverse. China is especially dependent on the outside world for capital energy and food, while it lacks a mature consumer economy and has, so far, failed to demonstrate the ability to consistently innovate at the level of OECD countries. So, once decoupled from multi-national supply chains, China’s growth is likely to collapse. And, coupled with its rapidly aging population, its gender imbalance, and the end of rising affluence, it is likely to face enormous social tension, which will force the Chinese Communist Party to turn inward.

Third, many developing countries will experience a rapid rise in affluence as they join the U.S.-led “global mainstream.”

Half or more of the manufacturing capacity exiting China will go to South and Southeast Asia. The Philippines, Indonesia, Malaysia, Thailand, Vietnam, Bangladesh, India, and maybe even Myanmar, could profit as multi-nationals work to ensure that their supply chains are secure and diversified. Pakistan, Russia, Iran, and several central Asian republics may be joined by non-Commonwealth countries in Africa to create a countervailing economic block led by China. However, China’s mercantilist economic doctrine will seriously limit the economic potential of this alliance. Longer-term, India will be a huge winner as its educated young people fill much of the gap left by the marginalization of China.

Fourth, to compensate for constraints on human capital, North America will focus on automation as will Europe, Taiwan, South Korea, Japan, Australia, and New Zealand.

In February, Bank of America/Merrill Lynch reported that its Factory Automation Indicator was already signaling an upward change prior to the COVID19 crisis. BofA went on to report, “better computing, along with improvements in optical sensing, machine vision, voice recognition, environmental sensors, motion actuators, and touch haptics is driving improved productivity and opening new possibilities for automation.” At the time, BofA projected a doubling of the global installed base of industrial robots to 5 million units by 2025. However, due to the anticipated automation trifecta of rapidly falling robot prices, improved flexibility, and increased productivity, the Trends Editors believe this forecast is far too conservative.

Fifth, aside from manufacturers and industrial automation companies, the biggest beneficiaries of supply chain relocation will be banks with a strong presence in North America, Southeast Asia, and South Asia.

They will benefit from increased opportunities in trade financing, working capital loans, foreign exchange trading, and treasury services as well as middle-market & transaction management services. And,

Sixth, the de facto cold war, described in trend #3, will intensify between a U.S.-led coalition and a China-led coalition.

China and its allies will be marginalized, and therefore play a diminishing role in global affairs. A key component of this confrontation will be erecting a “technological iron curtain,” which will proactively exclude China from the mainstream scientific and technological communities.

References

1. com. MAY 13, 2020. Chloe Taylor. Coronavirus will reverse globalization and create regional supply chains, economists predict.

2. The Review of International Organizations. January 28, 2019. Savina Gygli, et. al. The KOF Globalization Index ? Revisited.

https://link.springer.com/content/pdf/10.1007/s11558-019-09344-2.pdf

3. April 3, 2020. Kenneth Rapoza. The Post-Coronavirus World May Be The End Of Globalization.

4. com. May 23, 2020. Jun Du, et. al. Coronavirus Won’t Kill Globalization ? But A Shakeup is Inevitable.

https://theconversation.com/coronavirus-wont-kill-globalisation-but-a-shakeup-is-inevitable-137847

5. com. Feb 28, 2020. HAROLD JAMES. A Pandemic of Deglobalization?

6. BofA Global Research. February 7, 2020. Candace Browning Platt, et. al. Tectonic Shifts In Global Supply Chains.https://www.bofaml.com/content/dam/boamlhttps://www.audiotech.com/trends-magazine/images/articles/2020/05/documents/articles/ID20_0147/Tectonic_Shifts_in_Global_Supply_Chains.pdf

7. The Star. March 2, 2020. Anthony Dass. The back door to deglobalization.

https://www.thestar.com.my/business/business-news/2020/03/02/back-door-to-deglobalisation

8. Palgrave Communications. 25 February 2020. Jose Balsa-Barreiro, Aymeric Vie, Alfredo J. Morales & Manuel Cebrian. Deglobalization in a hyper-connected world.

https://www.nature.com/articles/s41599-020-0403-x.pdf

9. Foreign Policy. APRIL 3, 2020. HENRY FARRELL. A Most Lonely Union: The EU is a creature of multilateralism. Can it survive in a deglobalized world?

https://foreignpolicy.com/2020/04/03/brexit-european-union-deglobalization/

10. com. 05 May 2020. Douglas Irwin. The pandemic adds momentum to the deglobalization trend.

https://voxeu.org/article/pandemic-adds-momentum-deglobalisation-trend