|

|

|

|||

|

|

|

|

| |

|

|

| |

| 글로벌 트렌드 | 내서재담기 |

|

|  |

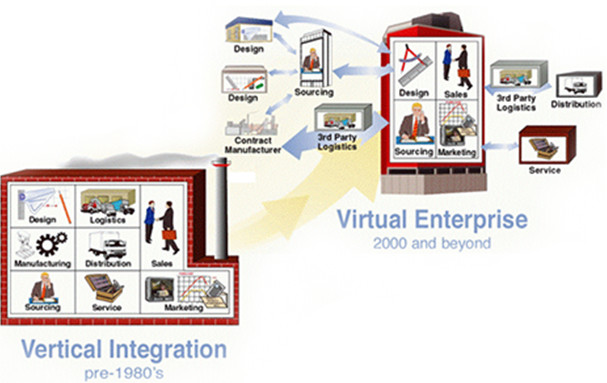

근 10여 년 동안, 세계적 트렌드는 수직 분산Vertical Disintegration을 지향하는 것이었다. 가치 체인의 모든 활동을 관리하는 대신 기업들은 핵심 역량에만 집중하고 그 외는 대부분 아웃소싱했던 것이다. 그러나 지금은 어떨까? 시계추가 이제 반대로 수직 통합Vertical Integration을 향해 움직이고 있다. 이렇게 예상치 못한 이동을 선도하고 있는 기업은 누구인가? 사업가와 투자자, 소비자가 고려해야 할 점은 무엇인가?

한 세기 전, 포드 자동차, US 스틸, 스탠더드 오일 등 산업계의 거인들은 생산 수단과 시장 경로 모두를 통제함으로써 경쟁 우위를 차지하려고 노력했다.

이러한 전략은 완벽해 보였다. 그들이 만드는 제품에 대한 수요가 급격히 성장하는 시대에, 포드 자동차는 고무 부품 등을 납품하는 1차 공급자가 납품가를 갑자기 두 배로 올려버릴 수 있는 위험 요소를 감수할 수 없었다. 또 차체 제작에 필요한 철강을 공급하는 주요 회사가 생산을 늦추거나 파산해 버릴 수도 있고, 원재료나 완성 차체를 수송하는 기차를 경쟁사가 포드보다 높은 가격을 불러 빼앗아 버릴 위험도 있었다. 따라서 대량생산 시대의 다른 대기업들과 마찬가지로, 포드는 자동차를 만드는 데 필요한 모든 것을 관리하고 통제함으로써 필요한 모든 자원을 확보하고자 했다. 포드는 고무 농장과 철광 광산, 심지어 철도까지 소유하고 있었다.

그러나 컨설팅 회사 스트라티지앤드Strategy&의 켄 파바로Ken Favaro가 최근 <전략+비즈니스Strategy+Business>지에서 언급한 바와 같이, “수직 통합은 1960년대에서 1970년대 초반 동안 복합사업체가 유행했을 당시의 선호로 인해 탄생했다. 그러나 이후 많은 산업에서는 수직 분산이 일어났다. 예를 들어, 오늘날 미국 자동차 산업으로 유입되는 자동차 부품의 3/4은 해외 아웃소싱을 통해서 들어온다.”

디지털 혁명 초기에는 새로운 기술과 세계화로 인해 가치 체인의 분산화가 가능했다. 기업들은 전 세계의 파트너들과 협력할 수 있었다. 특히 중국에서 저렴하게 만들 수 있는데, 기업들이 미국의 노동조합 노동자들에게 바다 건너 아웃소싱을 맡긴 중국의 노동자들보다 몇 배나 더 많은 급료를 지불하는 것은 바보 같은 짓이었다.

더욱이 C. K. 프라할라드Prahalad와 개리 하멜Gary Hamel이 1990년에 <하버드 비즈니스 리뷰>에 쓴 “기업의 핵심 역량” 등 가장 영향력 있는 경영 조언들은 대개가 ‘가장 잘 할 수 있는 일’에만 집중하고 나머지는 모두 ‘아웃소싱’을 하라는 내용이었다. 이러한 주장을 가장 잘 따른 모범 기업은 나이키였다. 운동화와 의류를 디자인하고 브랜드를 마케팅하는 일 외에 실제 생산은 모두 해외 벤더들에게 아웃소싱을 맡긴 것이다. 소프트웨어와 에너지 산업에서도 비슷한 일이 일어났다. 일부 기업들이 모든 것을 보유하기보다는 가치 체인의 특정 부분에만 집중했다. 정유 산업의 예를 들면, 각 기업이 원유 탐사, 원유 추출, 원유 정제, 원유 판매 등 고유의 업무에만 집중하는 식이다.

그러나 현재는 어떤가. 수직 통합이 “전방위full stack 비즈니스 모델”이라는 새로운 이름으로 다시 강력한 비즈니스 전략으로 부상하고 있다. 실제 가장 혁신적이고 성공적인 기업들 상당수가 오늘날 이미 이 전방위 전략을 이용하고 있거나 그 방향으로 이동 중이다.

▶ 넷플릭스와 아마존은 텔레비전 방송국으로부터 기존의 시리즈 판권을 구입해 오기보다는 자체적인 콘텐츠 생산에 집중하고 있다.

▶ 회원들에게 남성용 면도기를 판매해 온 해리스Harry’s는 최근 자체 면도기를 생산하기 위해 한 독일 공장을 인수했다.

▶ 애플과 디즈니는 자체 브랜드만으로 구성된 자체 매장을 운영 중이다.

▶ 테슬라는 100년 전의 포드 모델을 따라 자사의 전기차에 필요한 배터리를 생산하고 있으며, 또한 자동차를 소비자들에게 직판하고 자사 충전소를 통해 전기를 무료로 제공하고 있다.

▶ 스타벅스는 재배자로부터 직접 스타벅스 원두를 구매해 로스팅 한 후 자사 소유의 매장에서 판매하고 있다.

▶ 경쟁사보다 훨씬 저렴하게 안경테를 판매하는 워비 파커Warby Parker는 전방위 모델을 사용해 구매자의 경험 전반을 관리하는 안경 스타트업 기업이다. 이들의 연매출은 1억 달러 이상이며, <패스트 컴퍼니>가 선정한 2015년 가장 혁신적인 50대 기업에 이름을 올렸다.

이러한 변화는 향후 어떤 상황을 유도할까? 우리는 다음과 같이 예측해본다.

첫째, 전방위 접근 방식은 두 가지 조건을 충족하는 기업들에게 합당한 모델이 될 것이다.

켄 파바로에 따르면, 이들 조건은 각각 공급과 수요의 리스크 등 사업을 위협하는 ‘시장 실패’의 존재, 그리고 그 시장 실패를 극복할 수 있는 능력이다. 파바로는 “시장 실패의 가능성이 없다면 수직 통합은 과거와 마찬가지로 단순한 다각화일 뿐이며, 또 시장 실패를 극복할 능력이 없다면 전방위 모델은 아주 위험한 전략이 된다.”고 말했다. 예를 들어 넷플릭스가 <하우스 오브 카드House of Cards(미국 정치 스릴러 드라마)> 같은 드라마를 직접 제작하려는 것은 엔터테인먼트 산업의 경제적 특성을 드러낸다. 제작자가 수익을 주로 가져가는 구조이기 때문에 기존 텔레비전 방송국에서 라이선싱하는 것보다 넷플릭스가 직접 제작하는 것이 훨씬 더 저렴하다.

둘째, 수직 통합을 추구하는 기업들이 기업 인수 합병에 붐을 일으킬 것이다.

필요로 하는 역량 혹은 공급원을 직접 개발하는 데는 수년의 시간이 걸릴 수 있다. 따라서 시장을 지배하고자 하는 기업들은 전략적 인수를 시도하게 될 것이다. 예를 들어, 페레로 초콜릿은 ‘페레로 누텔라 헤이즐넛 스프레드’의 핵심 원료인 헤이즐넛의 선두적인 가공업체를 직접 인수했다. 페레로는 헤이즐넛을 주원료로 하는 자사 제품들을 위해 세계 헤이즐넛의 25%를 구매해왔다. 그러나 2014년 값이 폭등하면서 아예 가공업체를 인수한 것이다. 델타 항공은 제트기 연료의 안정적 공급을 위해 한 정유사를 통째로 인수했다. 두 가지 사례에서 각 기업은 공급 체인이 붕괴될 수 있는 가능성을 예방했다. 공급 체인 붕괴는 비즈니스 자체를 붕괴시킬 수 있고 소비자들이 기꺼이 지불할 수 있는 수준의 가격대를 넘어서는 상황이 오게 할 수도 있다. 같은 이유로 일부 분석가들은 홀푸드Whole Foods가 자연 식품 시장의 극심한 경쟁에서 살아남은 이유가 자사 유기농 식품의 생산 덕분이라고 믿는다.

셋째, 기업들이 전방위 전략을 추구하는 과정에서 가치 체인의 다른 부분으로 확대 진출하면서, 모든 산업이 동요할 것이다.

아마존이 자체적으로 글로벌 수송과 배송 네트워크를 갖춘 사실을 고려해보자. 유통과 공급 체인 관리를 다루는 무역 저널 <DC 벨로시티Velocity>는 아마존이 당시 2016년 말까지 자체 배송 네트워크를 도입할 것이라고 보도했다. 이는 소비자 입장에서 2시간 이내의 배송 보장을 의미하지만, 페덱스나 UPS와 같은 기존 배송 서비스로서는 아마존이라는 대형 고객을 잃고 사업에 큰 지장을 준다는 의미가 된다. 아마존으로서는 클라우드 컴퓨팅처럼 성공적인 비즈니스가 하나 더 늘어나는 것일 뿐 아니라 그 새로운 비즈니스를 통해 타 기업에 관련 서비스를 판매할 수도 있다. 베어드Baird의 애널리스트 콜린 세바스찬Colin Sebastian은 ‘인베스터플레이스닷컴investorplace.com’을 통해 이 새로운 시도는 아마존에게 4억 5,000만 달러의 가치가 있다고 밝혔다.

* *

References List :

1. Strategy+Business, Autumn, 2015, “Vertical Integration 2.0: An Old Strategy Makes a Comeback,” by Ken Favaro. ⓒ 2015 PwC. All rights reserved.

http://www.strategy-business.com/blog/Vertical-Integration-2-0-An-Old-Strategy-Makes-a-Comeback

2. Harvard Business Review, May?June 1990, “The Core Competence of the Corporation,” by C.K. Prahalad and Gary Hamel. ⓒ 1990 Harvard Business School Publishing. All rights reserved.

https://hbr.org/1990/05/the-core-competence-of-the-corporation

3. Strategy+Business, Autumn 2015, “Vertical Integration 2.0: An Old Strategy Makes a Comeback,” by Ken Favaro. ⓒ 2015 PwC. All rights reserved.

http://www.strategy-business.com/blog/Vertical-Integration-2-0-An-Old-Strategy-Makes-a-Comeback

4. For more insight into Warby Parker, visit the FastCompany website at:

http://www.fastcompany.com/3041334/most-innovative-companies-2015/warby-parker-sees-the-future-of-retail

5. Strategy+Business, Autumn 2015, “Vertical Integration 2.0: An Old Strategy Makes a Comeback,” by Ken Favaro. ⓒ 2015 PwC. All rights reserved.

http://www.strategy-business.com/blog/Vertical-Integration-2-0-An-Old-Strategy-Makes-a-Comeback

6. Seeking Alpha, September 1, 2015, “For Whole Foods Market, Vertical Integration May Become Its Whole Point of Sale,” by Jay Wei. 2015 Seeking Alpha. All rights reserved.

http://seekingalpha.com/article/3480796-for-whole-foods-market-vertical-integration-may-become-its-whole-point-of-sale

7. DC Velocity, October 21, 2015, “Amazon Assembling Executive Team to Support Rollout of Shipping Network,” by Mark B. Solomon. ⓒ DC Velocity, a publication of Agile Business Media LLC. All rights reserved.

http://www.dcvelocity.com/print/article/20151021-amazon-assembling-executive-team-to-support-rollout-of-shipping-network/

|  |

The Return of Vertical Integration

A century ago, the titans of industry - Ford Motor Company, U.S. Steel, Standard Oil, and others - strove to secure competitive advantage by controlling both the means of production and the path to market.

This strategy made perfect sense. At a time of rapid growth in demand for their products, a company like Ford couldn’t take the risk that its primary supplier of rubber would double its prices overnight. It couldn’t take the chance that the supply of metal it needed for automobile bodies would be available if key suppliers slowed production or went bankrupt. Neither could it expose itself to the possibility that a competitor would outbid Ford for access to railcars hauling raw materials to Detroit and finished automobiles to the rest of the country.

So like the other giants of the Mass Production Era, Ford secured the resources it needed by controlling everything it needed to build a vehicle. The company owned rubber plantations, iron ore mines, and railways?of course, it already owned the sprawling factories where its cars rolled off the assembly lines.

But as Ken Favaro of the consulting firm Strategy& noted recently in Strategy+Business, “[V]ertical integration largely fell out of favor when conglomerations became fashionable during the late 1960s and early ’70s. In fact, many industries underwent vertical disintegration. Today, for example, almost three-quarters of the parts going into American cars are sourced from outside the United States.”1

In the early years of the Digital Revolution, new technologies and the rise of globalization enabled the splintering of the value chain. Companies could collaborate with partners around the world. Low-cost manufacturing, particularly in China, made it foolish for U.S. companies to pay union factory workers high multiples of the cost of outsourcing production overseas.

Moreover, the most influential management advice, such as C.K. Prahalad and Gary Hamel’s 1990 Harvard Business Review article, “The Core Competence of the Corporation,” advocated that businesses “stick to their knitting” by focusing on what they do best and outsourcing all the rest.2 The most famous example of a company that followed this approach is Nike, which focused on designing athletic shoes and apparel and marketing its brand, while outsourcing the actual production of its products to outside vendors.

Similarly, in industries like software and energy, companies now focus on specific stages in the value chain rather than trying to own all of it. For example, in the oil business, some companies concentrate on finding oil, others on extracting it, others on refining it, and still others on selling it to consumers at the gas station.

But now, vertical integration is once again becoming a powerful business strategy, under a new name: the “full stack” business model.

In fact, many of the most innovative and successful companies today are already using or migrating toward the full stack strategy:3

- Netflix and Amazon are creating their own content rather than licensing existing television series from television networks.

- Harry’s, a company that sells men’s razors online using a subscription model, recently bought a German factory to manufacture its own blades.

- Apple and Disney operate their own stores dedicated exclusively to their own brands.

- Tesla is following Ford’s approach from 100 years ago by sourcing the batteries for its electric cars from its own plant, while selling the cars directly to consumers and providing them with free electricity via its Supercharger recharging stations.

- Starbucks purchases its own coffee from growers, roasts the coffee, and sells it through company-owned stores.

- Warby Parker, the eyeglass startup that uses a full stack model to control every aspect of the buyer experience (and sell fashionable frames for a fraction of the price charged by competitors) is raking in more than $100 million in annual revenues and was named #1 on Fast Company’s list of the fifty most innovative companies for 2015.4

In each case, the company is able to control its costs by owning the entire value chain. It also can control the consumer’s perception of the product by ensuring that it is displayed, supported, and priced in a way that benefits the brand rather than a third-party retailer.

Based on this trend, we offer the following forecasts:

First, the full stack approach will make sense for companies that meet two conditions.

According to Favaro, the first of these two conditions is the existence of a “market failure” that threatens your business, such as supply risk, demand risk, or profit gouging. The second condition is the ability to overcome that market failure.5 As Favaro notes, “Without market failure, vertical integration is just plain ole diversification. And without the power or capabilities to exploit a market failure, it’s a very risky strategy.” For example, Netflix’s foray into original programming with such shows as House of Cards reflects the economics of the entertainment industry. Due to profit gouging by producers, it is far cheaper for Netflix to develop its own shows than it is to license shows from a network.

Second, companies pursuing vertical integration will unleash a boom in mergers and acquisitions.

Rather than taking years to develop a needed capability or a source of supply, businesses seeking to dominate their markets will make strategic acquisitions. For example, the Ferrero chocolate company acquired the leading processor of hazelnuts, which is the key ingredient in Ferrero’s Nutella hazelnut spread. Delta Airlines recently acquired an oil refinery in order to stabilize its supply of jet fuel. In both cases, the companies preempted the possibility of a disruption in the supply chain that could either ground their business or elevate costs beyond what consumers would be willing to pay. For the same reasons, some analysts believe that the only way Whole Foods will be able survive in the face of stiff competition in the natural foods market is to produce its own organic foods.6

Third, as companies expand into other parts of their value chains to pursue a full stack strategy, entire industries will be disrupted.

Consider the rumored move by Amazon into developing its own global transportation and delivery network. As reported in the trade journal DC Velocity, which covers logistics and supply chain management, Amazon will introduce its own shipping network before the end of 2016.7 For consumers, the result will be guaranteed delivery in two hours or less. For established delivery services like FedEx and UPS, losing Amazon’s business would truly be catastrophic. As for Amazon, creating its own delivery service would add another service, like its successful cloud computing offering, that it could sell to other companies. According to Colin Sebastian of Baird, as cited on Investorplace.com, this could represent up to a $450 billion opportunity for Amazon.

References

1. Strategy+Business, Autumn, 2015, “Vertical Integration 2.0: An Old Strategy Makes a Comeback,” by Ken Favaro. ⓒ 2015 PwC. All rights reserved.

http://www.strategy-business.com/blog/Vertical-Integration-2-0-An-Old-Strategy-Makes-a-Comeback

2. Harvard Business Review, May?June 1990, “The Core Competence of the Corporation,” by C.K. Prahalad and Gary Hamel. ⓒ 1990 Harvard Business School Publishing. All rights reserved.

https://hbr.org/1990/05/the-core-competence-of-the-corporation

3. Strategy+Business, Autumn 2015, “Vertical Integration 2.0: An Old Strategy Makes a Comeback,” by Ken Favaro. ⓒ 2015 PwC. All rights reserved.

http://www.strategy-business.com/blog/Vertical-Integration-2-0-An-Old-Strategy-Makes-a-Comeback

4. For more insight into Warby Parker, visit the FastCompany website at:

5. Strategy+Business, Autumn 2015, “Vertical Integration 2.0: An Old Strategy Makes a Comeback,” by Ken Favaro. ⓒ 2015 PwC. All rights reserved.

http://www.strategy-business.com/blog/Vertical-Integration-2-0-An-Old-Strategy-Makes-a-Comeback

6. Seeking Alpha, September 1, 2015, “For Whole Foods Market, Vertical Integration May Become Its Whole Point of Sale,” by Jay Wei. 2015 Seeking Alpha. All rights reserved.

7. DC Velocity, October 21, 2015, “Amazon Assembling Executive Team to Support Rollout of Shipping Network,” by Mark B. Solomon. ⓒ DC Velocity, a publication of Agile Business Media LLC. All rights reserved.