|

|

|

|||

|

|

|

|

| |

|

|

| |

| 글로벌 트렌드 | 내서재담기 |

|

|  |

코로나19로 전 세계의 경제가 침체를 맞이하고 있다. 예상치 못한 변수로 인해 주식 시장에도 빨간 등이 켜졌다. 그러나 2030년까지의 장기적 추세를 보면 주식 시장은 계속 상승세에 있다. 메가트렌드로서 주식 시장의 현재와 미래를 알아보자.

.png)

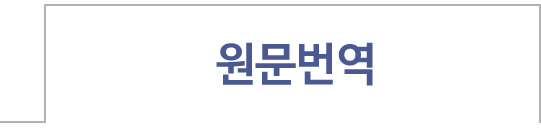

2017년 12월 경, 주식 시장은 장기 강세장과 연계되어 2013년을 시작으로 적어도 15년 동안 계속적으로 강세가 유지될 것으로 예측된다. 이는 디지털 기술 경제 혁명의 전개 단계에서 일어나는 자연스러운 부산물이다. 그리고 이 강세장은 디지털 기술 경제의 과도기 후반부터 시작되어 2032년에서 2035년 사이 이 새로운 시대가 정체될 때까지 유지될 것이다.

이와 비슷한 장기 강세장은 1982년부터 2000년까지 발생해 디지털 테크노 경제의 시작을 알렸고, 이 이전에는 1950년에서 1968년에 발생했는데 대량생산 혁명의 전개 단계에 그러했다.

이러한 시나리오에 대한 증거가 상당함에도 불구하고, 여전히 회의론자들의 의견은 밝지 않다. 이들은 경제 성장이 둔화되고 주식 시장이 약세장으로 회귀할 것으로 예측한다. 그러나 장기 강세장과 관련되어 디지털 시대가 가져다 줄 혁신은 장기적 관점에서 봐야 한다. 따라서 현재 해야 할 일은 이러한 장기 강세장의 현 위치와, 앞으로 갈 방향, 그리고 어떻게 활용할 지를 인지하는 것이다.

2020년 초, 약 13년에서 15년 정도 남은 이 장기 강세장은 현재까지 오는데 약 7년이 걸렸다. 그렇다고 모든 것이 긍정적이었다고 말하는 것은 아니다. 1991년의 불황이 1982년에서 2000년까지의 강세장에 일시적 일격을 가한 것처럼, 또 다른 상황이나 불황이 일시적으로 이번 강세장을 주춤거리게 만들 수 있다. 그럼에도 1949년부터 1966년까지의 장기 강세장은 한국 전쟁, 쿠바 미사일 위기, 케네디 대통령 암살과 관련된 세 차례의 부정적인 상황에도 불구하고 발생했다. 따라서 투자자들은 주기적 리스크를 예상하기 위해 항상 1년 정도를 바라보면서 장기 강세장을 활용하는 것이 좋을 것 같다.

현재로서 중요한 것은 2020년과 2021년 초 시장에 영향을 줄 수 있는 주기적 위험 요소를 고려하는 것이다.

순환 강세장과 장기 강세장의 미묘한 차이점 중 하나는 장기 강세장은 떠오르는 기술 패러다임에 근거하여 일관된 강도를 보인다는 것이다. 반면 순환 강세장은 단순히 중단기 비즈니스 사이클에 반응한다. 2009년 3월 이후 발생한 시장의 가파른 상승이 예측된 바 있는데, 거의 11년 동안 에너지 가격 전쟁이, 그리고 그리스와 베네수엘라와 같은 다양한 지역에서 중국과의 무역 분쟁과 금융문제가 있었음에도 이 기간 동안 시장은 계속해서 낙관적인 메시지를 전했다.

2009년부터 2013년까지, 이러한 주식의 상승 추세는 2000년에 시작된 장기 하락장 속에서 또 다른 순환적 회복의 형태로 나타났다. 실제로, 대부분의 투자자들은 2013년에 또 다른 새로운 최고점(new top)을 예상했는데, 많은 사람들은 이를 단순히 순환 강세장이 결국 도래한 것으로 믿었다. 그러나 이는 순환 강세장이 아니라 새로운 장기 강세장의 시작으로 보는 것이 타당할 것이다. 이러한 새로운 장기 강세장이 기술 경제의 주기에 있어 새로운 단계의 시작과 함께 동반되어왔기 때문이다. 이전 장기 강세장들을 근거로, 시장에서 탈주(break-out)와 리테스트(retest)가 한번 발생하면 약 18년에서 20년 정도의 장기적 상승세가 지속되는 것으로 나타났다.

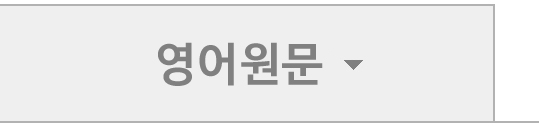

금융자산 관리자 크리스 시코바코(Chris Ciovacco)에 의하면, 1929년부터 2013년까지 S&P 500과 관련해 시장 패턴은 세 번 반복되는 모습을 보여준다.

2013년 2월 이후 S&P 500이 200% 상승했음에도 불구하고, 투자자와 투자 관리자 상당수는 여전히 회의적이다. 왜 그럴까? 한 가지 이유는 2008년-2009년의 두려웠던 금융 위기 기간 일어났던 마지막 순환 하락장에 대한 심리 때문이다. 결과적으로 이들 중 많은 사람들이 기존의 롱온리(long-only, 주식 매수 후 보유) 에쿼티(Equity) 리스크를 여전히 두려워하고 있다. 이는 개별 투자자, 연금, 기부금, 재단, 헤지 펀드의 실질적인 공모주 할당이 잠재적인 기회를 최대한 활용하는 것보다 지분 보유의 위험을 제한하는 데 더 집중되어 있다는 사실에 의해 확인된다.

임박한 하락장, 섹터의 붕괴, 혹은 좋지 않을 것이라는 몇몇 극단적인 추측이 금융 매체에 가득하다. 방어 포트폴리오 수입 전략을 옹호하지 않는 강세 애널리스트들은 의심을 받고, 전체적인 강세장을 보지 않는 약세 예측 전문가들은 구로(guru)로 칭송받고 있다.

물론 우리가 FUD 요소라고 부르는 공포(fear), 불확실성(uncertainty), 의심(doubt)의 유행은 재난에 대한 최선의 보험과 같다. FUD의 장점은 ‘우려의 벽’을 쌓아 강세장에 거품이 끼지 않도록 하는 역할을 해준다. 모든 사람들이 특정 자산군(1999년 닷컴 주식, 1600년대 튤립 구근, 2007년 주택, 1989년 일본 부동산)을 소유하는 것이 부자가 되는 확실한 길이라고 결론을 내릴 때 거품이 발생한다. 따라서 FUD 요소가 사라짐과 동시에, 투자자들은 순환 트렌드, 심지어 강세 트렌드에 대해서도 신중한 검토와 고민이 필요할 것이다.

다만 메가트렌드로서 앞으로 디지털 기술 경제 혁명과 관련된 주식에 있어 장기 강세장이 출현하고, 이 트렌드는 2030년 중반까지 계속될 것은 확실해 보인다. 물론 전쟁이나 자연 재해와 같은 예측이 어려운 요소들도 존재할 것이다. 그러나 어떠한 위기 속에서도 상승 트렌드는 여전히 지속될 것으로 보인다.

장기 강세장과 관련하여 우리는 다음과 같이 예측해본다.

.png)

첫째, 미국은 2021년 2분기 초까지는 거대 불황을 경험하진 않을 것이다.

미국 경제가 잠정적으로 경기 침체를 향하고 있다는 점을 인지하는 것이 성공적인 투자 결정에 있어 가장 중요하다. iMarkets Business Cycle Index(BCI)는 경기 침체에 대한 정보를 제공하는데, 이들은 7가지 통계를 사용한다.

- 일 단위 10년 재무부 수익률

- 일 단위 3개월 재무부 수익률

- 일 단위 S&P 500 지수

- 주 단위 조정 실업 급여

- 월 단위 민간 고용 총수

- 월 단위 신규 주택 총수

- 월 단위 신규 주택 판매

BCI의 최고점에서 하락을 측정하는 BCIp라는 변수가 25미만으로 떨어지면, 20주 평균 선행 경기 침체 경고 신호가 발생한다. 이 BCIp가 2020년 2월 중순 거의 100에 도달했다. 2020년에는 협력적인 연방준비제도, 낮은 실업률, 높은 소비자 신뢰도, 그리고 다수의 새로운 무역 협정으로 인한 혜택 등이 경기에 힘을 보탤 것이다. 이로 인해 중단기적인 침체의 경우가 발생할 수는 있어도 장기적으로는 그렇지 않을 것이다.

.png)

둘째, 역사적인 패턴에 근거하여, 2035년까지 주식 시장 수익률이 더 높아질 것이다. 주식은 채권에 비해 여전히 저평가되어 있기 때문이다.

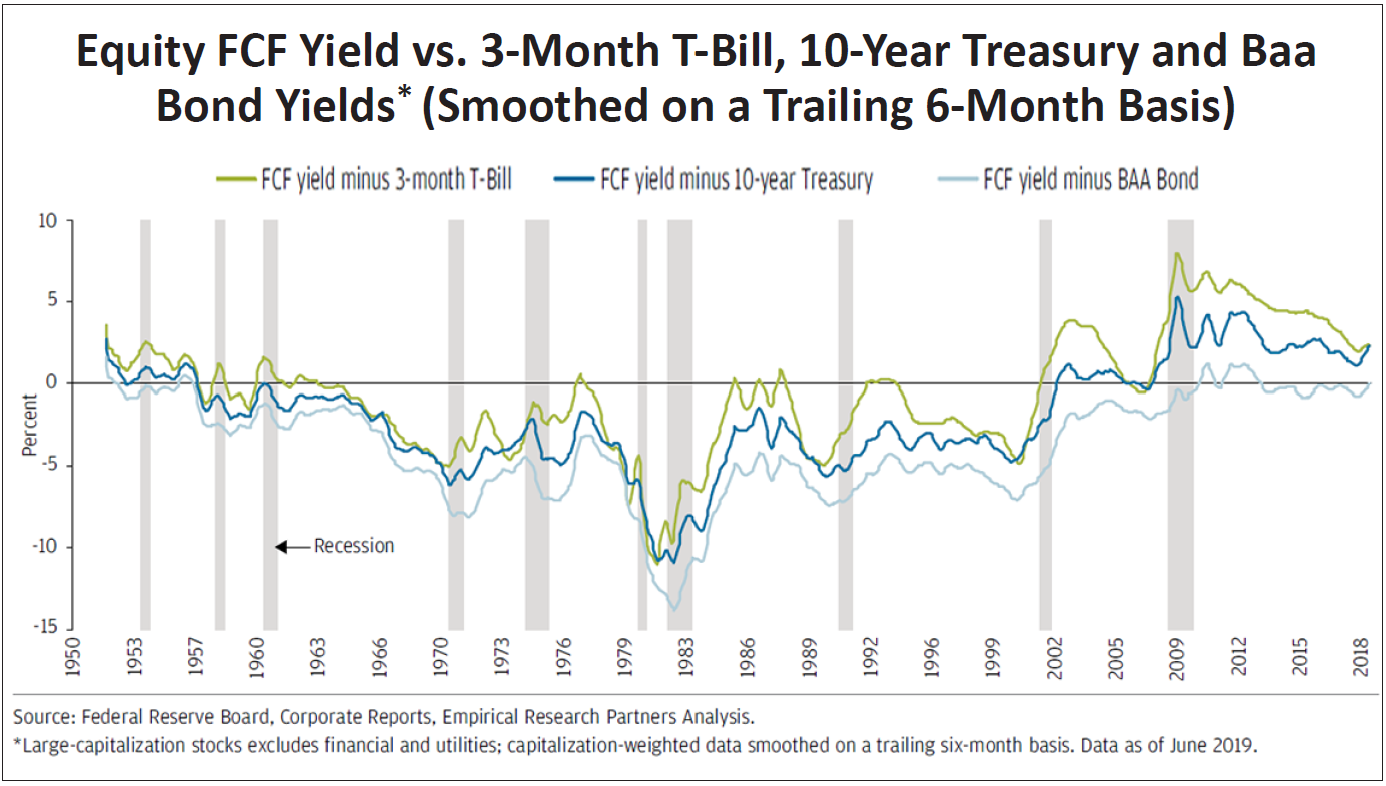

JP모건은 2030년 중반까지 장기 강세장이 지속될 것으로 예측하고 있다. 금융 시장의 진실은‘자본은 가장 큰 수익이 나는 곳으로 이동한다’는 것이다. 사람들은 가장 크고 유동적인 자산 풀로서 주식, 채권, 현금에 대한 수익을 항상 비교한다. 정부와 기업의 채권에 비해 주식은 상대적으로 현금 흐름이 자유롭고, 수익률은 계속 상승 중이다. JP모건에 따르면, 1950년대 초와 2009년 금융 위기 이후 상당 기간 주식은 높은 수익률을 자랑했다. 이러한 패턴은 오늘날에도 여전히 반복될 것으로 예상된다.

셋째, 인구 통계학적 추세가 향후 15년 동안 주식에 대한 높은 기대 수익을 지원할 것이다.

더 많은 베이비붐 세대가 퇴직 연령에 도달함에 따라 주식의 성과가 움츠러들 것이라는 잘못된 믿음이 있다. 그러나 데이터는 역으로 높은 성과를 보여주고 있다. 브루킹스연구소(Brookings Institute)에 따르면, 주식시장에서 35세-49세의 비율이 20세-34세의 비율보다 클 때 평균 이상의 수익률을 기대할 수 있을 것으로 보고 있다. 이 비율은 최근에 들어 상승하기 시작했고 이 인구 통계학적 추세는 2030년 중반까지 계속 더 높아질 것이다. 브루킹스연구소는 35세-49세의 연령층이 다양한 장기 목표를 위해 주식에 대한 다소 비탄력적인 수요가 있는 것으로 파악하고 있다. 2차 세계 대전 이후의 베이비붐, 1970년대의 출산 증대, 밀레니엄 세대의 출산 급증과 같은 출생률 변수는 항상 강세장과 하락장의 변동을 설명할 수 있는 요소로 간주되어 왔다. 특히 기술(자동화, 인공 지능, 자율 주행 차량, 소프트웨어, 유전자 시퀀싱 등)의 개선과 진보로 인해 일어난 생산성 증가와 규모의 경제로 인해 이들 35세-49세의 생산성이 증대된 것도 또 하나의 이유가 될 것이다.

* *

References List :

1. Seeking Alpha. 21, 2019 Bill Kort. Most Disrespected, Unloved And Disbelieved Secular Bull Market Since The Last One.

https://seekingalpha.com/article/4255552-disrespected-unloved-and-disbelieved-secular-bull-market-since-last-one

2. Seeking Alpha. 19, 2017. Chris Ciovacco. How Was The Collective Mood As Stocks Started A 19-Year Secular Bull Run In 1982?

https://seekingalpha.com/article/4037991-how-was-collective-mood-stocks-started-19-year-secular-bull-run-in-1982

3. December 15, 2017. Trends Editors. The Truth About Today’s Bull Market.

https://audiotech.com/trends-magazine/truth-todays-bull-market/

4. Seeking Alpha. 30, 2020. Kerry Balenthiran. Secular Bull Market To Last Until 2035.

https://seekingalpha.com/article/4320330-secular-bull-market-to-last-until-2035

5. P. Morgan & Co. August 2019. Giri Devulapally. Why we’re in the early innings of a secular bull market.

https://am.jpmorgan.com/gi/getdoc/1383636191833

6. net. 19 January 2020. Vince Golle, Reade Pickert, Yue Qiu, and Alexander McIntyre. US recession chances dip further on job growth, record stocks.

https://tbsnews.net/international/global-economy/us-recession-chances-dip-further-job-growth-record-stocks-37515

7. Feb. 20, 2020. Georg Vrba. No Recession Signaled By IMs Business Cycle Index.

https://seekingalpha.com/article/4325754-no-recession-signaled-ims-business-cycle-index-update-february-20-2020

|  |

Riding the Secular Bull Into the 2030s

On December 15, 2017, the Trends editors wrote, “Stocks are currently involved in a secular bull market. It began in 2013 and it is likely to run for at least another 15 years. It’s a natural by-product of the Deployment Phase of the Digital Techno-Economic Revolution. It began in the latter stages of the [Revolution’s] Transitional period and will continue until this revolution plateaus” between 2032 and 2035.

We went on to say, “A similar secular bull market ran from 1982 to 2000, marking the Installation Phase of the Digital Revolution while the one prior to that ran from 1950 to 1968 marking the Deployment Phase of the Mass Production Revolution.”

In spite of the growing evidence for this scenario, we still hear protests from skeptics, expecting us to return to slow growth, a “new normal” economy and a lackluster stock market. They constantly seek new reasons for this boom to come crashing down.

Meanwhile, those who enthusiastically embrace the Secular Boom and the related Digital Revolution need to know where this bull market stands, where its headed in the short-to-medium term, and how they can take advantage of it.

In early 2020, we’re nearly seven years into the secular bull with an estimated 13-to-15 years left to run. But that doesn’t mean everything is headed straight up. Just as the 1991 recession briefly interrupted the 1982 to 2000 secular bull, don’t be surprised when another recession temporarily interrupts this secular bull. Similarly, the secular bull market from 1949 to 1966 occurred despite three recessions associated with the Korean War, the Cuban Missile Crisis and the assassination of President Kennedy. For this era, investors need to trust the long-term secular trend, while always looking a year or so out to anticipate cyclical risks.

Rather than spend a lot of time on the broader issues related to the pace of the Fifth Techno-Economic Revolution, this segment focuses on the market-related indicators that demonstrate that this is a genuine secular bull and that it’s nowhere near its end. More importantly, we consider some of the cyclical risk factors that might impact markets in 2020 and early 2021.

One of the subtle differences between cyclical and secular bull markets is that secular bulls exhibit consistent strength, grounded in an emerging technological paradigm; cyclical bulls simply respond to the medium-term business cycle. Those who subscribe to our sister publication, Business Briefings know that we’ve persistently forecast the inexorable rise of the market that’s occurred since March 2009. Over that period, the market has continued to send its upbeat message, week-after-week, for nearly 11 years, in spite of energy price wars, a trade war with China and financial problems in places as diverse as Greece and Venezuela.

From 2009 to 2013, this uptrend in stocks appeared to be another cyclical recovery within the secular bear market that began in 2000. In fact, most investors expected just another new top in 2013, which many believed was simply a cyclical bull market coming to an end. However, the Trends editors and a few others declared this to be the start of a new “secular bull market.” We were especially confident, because this break out confirmed what we were looking for based on the theory of Techno-Economic Revolutions as described in our book, Ride the Wave.

We knew that a new secular market always accompanies the beginning of a new phase in the techno-economic cycle; for instance, a secular bear market emerged in 2000 with the beginning of the Transition Phase. By 2013, we knew that the pump was primed for launching the Deployment Phase of the Digital Revolution, but we had to wait for market signals before we could acknowledge that the financial markets had begun to anticipate the new era. In 2013, that signal arrived in the form of a breakout above the long-established range as well as a successful retest of the breakout which confirmed that the new secular trend was in place.

Based on previous secular bull markets, once the break-out and retest occurred, we knew that the subsequent rise would last for a long time; probably 18 to 20 years.

Previously, we’ve used a graphic created by money manager Chris Ciovacco to illustrate this point; it’s shown in the printable Trends issue this month. It illustrates this market pattern repeating itself three times in the context of the S&P 500 over the years 1929 to 2013.

Despite the 200% rise in the S&P 500 since February 2013, a large share of investors and investment managers remain skeptical. Why? One reason is that the last cyclical bear market, which occurred during the emotional and scary financial crisis of 2008 to 2009, permanently damaged their psychology. Consequently, many of them remain scared of traditional long-only equity risk. This is confirmed by the fact that actual public equity allocations for individual investors, pensions, endowments, foundations, and hedge funds remain more focused on limiting the downside risk of equity holdings than on exploiting potential opportunities.

The financial media is full of commentary speaking of an imminent bear market, the collapse of a sector, or some extreme speculation that will end badly. Bullish analysts who arent advocating defensive portfolio income strategies are treated with suspicion, whereas bearish pundits, many of whom have missed the entire bull market, are considered gurus.

Fortunately, the prevalence of fear, uncertainty, and doubt, which we refer to as the “FUD Factor,” is our best insurance against disaster. FUD creates the proverbial “wall of worry” which keeps a bull market from becoming a bubble. A bubble occurs when everyone concludes that owning a specific asset class (like dot-com stocks in 1999, tulip bulbs in the 1600s, houses in 2007, or Japanese real estate in 1989) is a sure-fire road to riches. As soon as FUD disappears, the cyclical trend and perhaps even the secular trend needs to be carefully reexamined.

As futurists who invest our own money, the Trends editors expect the secular bull market in equities associated with the Digital Techno-Economic Revolution to continue until the mid-2030s, with occasional cyclical interruptions. We carefully avoid giving financial advice and we are quick to warn that unforeseeable factors like war and natural disasters can disrupt even the strongest trends. However, it’s clear that the opportunity remains strongly tilted to the upside.

Given this trend, we offer the following forecasts for your consideration.

First, investors’ recent allocation of funds away from equities is consistent with a 5-year cumulative return of over 90% on the S&P 500 through 2024.

In late December 2019, U.S. cash outflows from equity mutual funds and ETFs to fixed income assets (like bonds) reached a historical high. The specifics are shown in this month’s printable issue of Trends. On the four most recent occasions when this happened, it presaged extraordinarily high stock market returns. Why? When hundreds of billions of dollars are ultimately reallocated from bonds to stocks, the transition will drive up prices dramatically.

Second, the United States will not experience a recession until the 2nd quarter of 2021, at the earliest.

Knowing when the U.S. economy is heading for a recession is paramount to successful investment decisions. At Trends one of our favorite tools for doing so is the weekly iMarkets Business Cycle Index (or BCI). A chart in the printable issue shows the BCI in the context of the past seven recessions. This metric uses the following seven U. S. economic stats:

1. The daily 10-year Treasury yield;

2. The daily three-month Treasury bill yield;

3. The daily S&P 500 index;

4. The weekly Seasonally Adjusted Continuing Unemployment Claims;

5. The monthly total of all Private Industry Employees

6. The monthly number of new houses for sale; and

7. The monthly number of new houses sold

On average, a 20-week leading recession warning signal is generated when a variant called BCIp, which measures the BCI’s fall from its peak, goes below 25. As shown in the printable issue, BCIp was at almost 100 in mid-February 2020. Similarly, a model used by Bloomberg Economics and updated in mid-January estimates the chance of a U.S. recession within the next year at 26%. This makes sense: an accommodative Fed, low unemployment, high consumer confidence, and benefits flowing from multiple new trade agreements, all bode well for the U.S. in 2020.

Third, based on historic patterns, we will see stronger stock market returns through 2035 because stocks are undervalued relative to bonds.

At J. P Morgan they agree that we are in a secular bull market that will last until the mid-2030s. A truism of financial markets is that “capital goes where it is treated best.” To answer this question, we are primarily interested in comparing returns on stocks, bonds and cash, the three biggest and most liquid pools of assets. The relative free cash flow yield of stocks compared to both government and corporate bonds are especially pronounced in the context of history. The free cash flow yield of stocks relative to BAA bonds is the most revealing because investors are currently willing to accept the same free cash flow yield on corporate bonds as on equities, a situation that has existed only 6% of the time over the past 66 years. As J. P. Morgan observes, those time periods, in the early 1950s and since the Great Financial Crisis of 2009, have been followed by very strong equity returns. We expect history to repeat itself and the high level of fear implied by this spread will normalize as a result of above-average returns inequities. And,

Fourth, demographic trends will support expected high returns on equities over the next 15 years.

There is a widespread but fallacious belief that as more baby boomers reach retirement age, demographics will present a headwind for equity performance. On the contrary, data suggest that rather than being a headwind, demographic trends may be quite supportive of high equity returns. According to a research paper by the Brookings Institute, we can expect to see above-average equity returns when the ratio of 35?to-49-year-olds is increasing relative to 20-to ?34?year?olds and to see below-average equity returns when this ratio is decreasing. This so-called Middle-to-Young Ratio has only recently started to rise and is set to continue rising until the mid-2030s. The main premise in the Brookings paper is that middle-aged people have a somewhat inelastic demand for equities given their need to save for various long-term goals. The variation in birth rates related to

- The baby-boom following World War II,

- the baby-bust of the 1970s, and

- the birth surge of millennials is viewed as an explanatory cause for the variation of the secular bull and secular bear markets, which we described earlier.

The increase in demand for equities due to demographic trends combined with the reduced supply of equities (caused by high levels of buybacks and modest levels of stock issuance) could lead to an even more pronounced boost in equity prices in this cycle. The Brookings paper also suggests that 35?to-49-year-olds are more productive than other cohorts in the working population. This assessment makes intuitive sense as 35?to-49-year-olds are likely to have finished their training and gained relevant experience in their chosen professions. The potential for higher-than-anticipated productivity is supported by two additional factors.

First, given the low level of unemployment in the U.S., it will be uneconomic for corporations to increase output by hiring relatively scarce and expensive employees. Instead, they have a strong incentive to boost productivity by increasing capital expenditures. And,

Second, several trends in technology (industrial automation, artificial intelligence, self-driving vehicles, the democratization of software, genetic sequencing, and so forth) have achieved sufficient scale and are set to modestly boost productivity, even in the medium-term.

References

1. Seeking Alpha. 21, 2019 Bill Kort. Most Disrespected, Unloved And Disbelieved Secular Bull Market Since The Last One.

2. Seeking Alpha. 19, 2017. Chris Ciovacco. How Was The Collective Mood As Stocks Started A 19-Year Secular Bull Run In 1982?

3. December 15, 2017. Trends Editors. The Truth About Today’s Bull Market.

https://audiotech.com/trends-magazine/truth-todays-bull-market/

4. Seeking Alpha. 30, 2020. Kerry Balenthiran. Secular Bull Market To Last Until 2035.

https://seekingalpha.com/article/4320330-secular-bull-market-to-last-until-2035

5. P. Morgan & Co. August 2019. Giri Devulapally. Why we’re in the early innings of a secular bull market.

https://am.jpmorgan.com/gi/getdoc/1383636191833

6. net. 19 January 2020. Vince Golle, Reade Pickert, Yue Qiu, and Alexander McIntyre. US recession chances dip further on job growth, record stocks.

7. Feb. 20, 2020. Georg Vrba. No Recession Signaled By IMs Business Cycle Index.