|

|

|

|||

|

|

|

|

| |

|

|

| |

| 글로벌 트렌드 | 내서재담기 |

|

|  |

코로나19 팬테믹으로 인해, 그 이전부터 재정이 불안정했던 주(states)에 큰 위기가 닥치고 있다. 당장 파산을 선언해야 할 수도 있다. 그러나 미국 연방법에 따르면 주는 파산을 신청할 수 없다. 이에 최근 주도 파산을 신청할 수 있는 방안이 마련되어야 한다는 의견이 모아지고 있다. 주의 파산에 대한 정치적, 법적 이슈와 앞으로 어떤 일이 벌어질 것인지 알아보자.

코로나19 팬데믹으로 인해 미국의 각 주가 예산 수입과 지출 측면에서 모두 피해가 발생하면서, 이에 대한 우려를 표하는 주지사가 점점 늘어나고 있다. 이러한 문제를 해결하기 위해 2조 달러의 ‘코로나 바이러스 구제 및 경제부양법(Coronavirus Aid, Relief, and Economic Security, CARES)에 따라 300억 달러 규모의 교육 기금, 450억 달러의 재난 구호 기금, 그리고 기타 소규모 관련 프로그램들에 추가로 주 및 지방 정부에 1,500억 달러가 제공되었다. 그러나 이러한 막대한 금액조차도 대규모로 진행되는 비즈니스 폐쇄, 세금 수입 급락, 새로이 발생하는 의료 및 실업 보험 비용으로 인해 야기된 막대한 혼란을 피하기에는 불충분하다. 더욱이 뉴욕, 뉴저지, 일리노이, 캘리포니아와 같은 주들이 비즈니스 활동에 대한 완전한 재개를 연기함에 따라 하루 하루 이러한 위협은 더욱 더 커지고 있다.

코로나19와 상관없이 팬데믹 이전부터 자신들의 예산 문제를 해결하는 데 반복적으로 실패해왔던 주의 경우 상황은 더욱 심각하다. 꽤 많은 주들이 그러하다. 기존 예산에 대한 문제 해결 능력도 현저히 떨어지는 이러한 주들의 경우 코로나19 팬데믹은 재앙과 가깝다. 공무원 퇴직 연금이 크게 부족한 주에서는 더욱 더 그렇다. 공무원들에게 넉넉한 퇴직 연금을 제공해왔던 많은 주들이 이제는 연금 전액을 지원하지 못하고 있다.

부분적으로 이것은 필요한 자금이 다른 곳에 쓰였기 때문이다. 지난 10년 동안 높은 투자수익율 뿐만 아니라 회계상의 특수효과는 과잉된 부담을 지고 있는 주들이 적어도 파산은 하지 않도록 해줬다. 그러나 경제 재앙이 백화점 체인점 JC 페니(JC Penney), 100년의 역사를 지닌 백화점 니만 마커스(Neiman Marcus), 세계 1위 렌터카 업체이자 102년 역사를 자랑하는 자동차 렌탈회사 허츠(Hertz)와 같이 부채가 많은 회사를 파산시켰듯, 미국 내 많은 주들도 비슷한 상황과 직면하게 되었다.

시와 카운티, 기타 지방자치단체에게 파산을 승인하는 미국 파산법(the U.S. bankruptcy code) 제9조에 주를 포함시키는 아이디어가 다시 수면에 오른 것은 바로 이러한 맥락에서 나왔다. 파산 범위를 확대하면 주 정부가 파산을 신청할 수 있게 된다.

논란의 여지가 있지만 파산을 신청하는 ‘정치 관할권’에 대한 아이디어는 최근에 등장한 급진적인 것이 아니다. 실제로 1980년 이후 도시와 카운티, 타운, 빌리지를 포함하여 총 54번의 제9조 제출이 있었다. 그렇다면 그 대상을 주 단위로 확대하는 것이 현실적인 것일까? 사실들을 살펴보자.

이상적으로, 주의 파산은 재정 상황을 올바르게 균형 잡으려고 노력하는 것이다. 이것은 입법부와 주 정부가 대중과 은퇴자, 채권자들에게 의무를 이행하기 위해 필요한 예산 조정을 단행함을 의미한다. 그러나 특히 재정적으로 부담이 많은 주의 경우 공공 서비스를 크게 줄이지 않으면 정치적으로나 경제적으로 모두 실현 불가능한 것은 분명하다.

10년 전, 제너럴 모터스와 크라이슬러는 수십 년간 잘못된 관리와 열악한 성과, 과도한 노동 및 퇴직 비용으로 파산에 빠졌다. 비슷한 방식으로, 주 정부의 수십 년 동안의 잘못된 관리와 단기적인 정치적 의사결정은 결국 경제적 현실과 충돌했다. 그러나 오늘날, 주의 경우 파산을 통해 모든 것을 깨끗하게 정리할 수 있는 옵션이 없다.

그렇다면 주의 경우 파산과 관련하여 현재 어떤 대안 옵션이 있을까? 선호하는 옵션은 연방 구제 금융을 얻는 것이다. 그러나 그 방식은 현재 지나치게 넉넉한 공무원들에 대한 보상을 개혁하는 동기가 되지 못한다. 사실 문제의 원인이 거기에 있음에도 그렇다. 이러한 구제 금융 방식은 주 정부가 계속 잘못된 선택을 하도록 유도할 뿐이다. 또한 재정적으로 신중한 주의 주민들에게 자신들이 가진 범위 내에서 살기를 거부하는 다른 주를 구제하라고 요구하는 것이기도 하다. 그리고 이렇게 구제 금융을 필요로 하는 주의 상당수는 실제로는 상당히 부유하기까지 하다.

대안으로서 주권 주체로서 각 주는 그들의 부채를 간단하게 탕감할 수 있다. 그러나 그것은 공공 부문의 노동자들이 납세자와 채권자들의 희생으로 보호를 받는 것을 의미한다. 그리고 이 방식은 해당 주들이 ‘정크 본드 금리’ 이외에는 자금을 차용할 수 없게 만들 것이다. 무엇보다도 최악은 뉴욕과 일리노이의 현재 납세자들이 더 높은 금리를 지불하는데도 공공 서비스는 줄어들고, 현재 플로리다에 거주하는 공공 부문 퇴직자들에게 자금을 지원할 것이란 점이다.

맥코넬(McConnell) 공화당 상원 원내대표가 올해 구제 금융이 없을 것이라고 분명히 밝히기 전까지는 주가 파산 보호를 신청하게 한다는 아이디어는 단지 가상의 제안일 뿐이었다. 실제로, 맥코넬 의원은 주 정부를 포함시키기 위한 제9조 파산 대상의 확대가 ‘많은 수의 주들이 현재 직면하고 있는 위기를 완화시키는데 의회가 그 수단으로서 심각하게 고려해야 하는’ 매력적인 대안이라는 과감한 주장을 펼쳤다. 당연히 이것은 엄청나게 부족한 공무원 연금에 대해 부채를 지고 있는 일리노이, 뉴욕, 캘리포니아와 같은 주 전역에 충격파를 보냈다.

그러나 연방 구제 금융이 없다면, 맥코넬 의원의 제안은 ‘선택적 부도’ 및 ‘부채 거부’보다 훨씬 더 나은 대안으로 보인다. 선택적 부도와 부채 거부는 많은 새로운 문제를 야기할 뿐만 아니라 현재의 문제를 해결하는 데도 거의 도움이 되지 않는다. 이는 사실인데, 문제를 겪고 있는 대부분의 주들 상당수가 주 헌법 조항에 제약을 받기 때문이다. 주 헌법 조항은 주가 광범위한 방식으로 그들 대차대조표를 수정하는 데 필요한 유연 옵션(flexible option)을 금지하고 있다. 가장 중요한 것은 많은 주 헌법들에는 법원에서 해석한 조항들이 포함되어 있다는 것이다. 이 조항들은 주와 지방 공무원들이 퇴직할 때까지 삭감없이 고용 시 유효했던 공식에 기반하여 연금을 받을 권리를 보장하고 있으며, 이러한 주의 의무는 변하지 않도록 되어 있다.

파산 신청을 주 범위로 확대하는 아이디어는 앞서 말했듯이 새로운 것은 아니다. 펜실베이니아대학교(University of Pennsylvania) 법학과 데이비드 스킬(David Skeel) 교수는 기업 금융 및 파산 전문가로 2007년∼2009년의 대불황 이후 이 아이디어를 최초로 공개한 바 있다. 그는 파산 절차를 통해 주 정부는 지속 불가능한 채권 부채를 즉시 줄이고, 낭비되고 있는 세비 지출을 줄이며, 지속 불가능한 공무원 퇴직 연금 의무를 재설계할 수 있다고 주장했다. 듀크대학교 법학과 스티븐 슈와르츠(Steven Schwarcz) 교수는 이러한 목표를 달성할 수 있는 주 파산법 모델을 설계하기도 했다.

결론은 무엇일까? 파산 매커니즘을 주 단위로 확대하면 현재의 대안 조치들을 통해 일부 문제들을 피할 수 있다는 점이다. 그러나 현재의 제9조 파산은 상충되는 정치적 역학을 다독이는 만병통치약은 아니다. 디트로이트와 같이 더 크고 더 많은 부채를 가진 지방자치단체들의 최근 파산 사례가 많아짐으로써 그러한 과정이 정치와 무관하기란 어렵다는 것이 노출되었다. 더욱이 도시 파산에서 발생하는 몇몇 문제를 피하기 위해, 주가 파산 자격을 갖추기 전에 상식적인 개혁이 필요할 것으로 보인다.

이러한 상황과 조건을 통해, 우리는 다음과 같은 예측을 내려볼 수 있다.

첫째, 파산 대상의 확대 또는 연방 구제 금융이 코로나바이러스 구제 법안의 국면에서 이뤄질 가능성은 비록 낮지만, 이것은 2020년 선거에서 중요한 사안이 될 것이다.

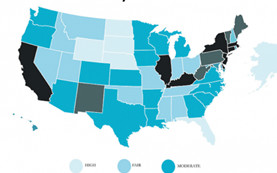

민주당은 이미 소위 히어로즈 법안(HEROES Act, Health and Economic Recovery Omnibus Emergency Solutions Act - 건강 및 경제 회복 긴급대책 법안)의 일환으로 주의 구제 금융을 승인했다. 그러나 상원의 지배력을 얻거나 선거인단 승리를 달성한다는 측면으로 보면, 이 구제 금융으로부터 혜택을 얻게 될 핵심 주는 소수에 불과할 것이다. 더욱이 경제를 재개하는 속도의 차이로 인해 각 주가 직면하는 경제 상황에 따라 유권자들의 기호가 정해질 것 같다. 일리노이, 뉴욕, 뉴저지, 캘리포니아와 같은 민주당 강세 지역의 유권자들과 미주리, 플로리다, 조지아, 텍사스와 같은 공화당 강세 지역의 유권자들이 누구를 선택할까? 11월 선거에서 이에 대한 결론이 날 것이다.

둘째, 공화당이 하원을 지배하고 대통령과 상원까지 유지한다면, 앞으로 주 정부에게 파산 신청이 승인될 수도 있을 것이다.

물론 상황에 대한 정치적, 헌법적 측면에서 신중한 고려가 진행되어야 할 것이다. 예를 들어, 미국 헌법상 연방 체제 하에서 주권 단체로서 각 주들은 그들 법에 따라 부채를 전체적으로 또는 부분적으로 거부할 수 있는 옵션을 유지할 것이다. 제11조 기업 파산과 달리 제9조는 채권자가 비자발적 파산 절차를 시작할 수 있는 어떤 옵션도 제공하지 않는다. 그러나 주들에게 파산을 신청할 수 있는 옵션이 제공된다면, 이는 각 주에게 전면적인 디폴트에 대한 운용 가능한 대안을 제공할 뿐만 아니라, 실제로 파산 신청을 하지 않고도 합의 조정에 도달할 수 있는 지렛대를 제공하게 될 것이다.

셋째, 주에게 파산이라는 대안을 제공하면, 각 주들은 그들의 기존 법을 회피할 수 있을 것이다.

미국 헌법의 최고법 규정에 따라 연방 파산법은 주 헌법상의 제약을 무효화하여 법원이 현재 공공 부문 노동자와 현재 은퇴자들의 연금 혜택을 조정하게 된다. 파산은 기득권에 대한 재산권을 유지하지만, 공무원 연금 계약을 포함한 모든 계약상 보장의 재설계를 허용한다.

넷째, 엄격하게 시행되는 파산법은 모든 채권자가 동등하게 대우받을 수 있도록 하고, 지속 불가능한 미래의 약속을 피할 수 있는 인센티브를 창출할 것이다.

모든 청구인들이 파산의 고통을 균등하게 공유하도록, 그리고 그러한 계획이 ‘경제적으로 실현 가능’하도록 요구하는 것은 공정할뿐더러, 모럴 해저드를 제한하고 모든 당사자들에게 긍정적인 인센티브를 창출할 것이다. 제11조와 마찬가지로, 제9조에서도 재설계 혹은 재구성 계획이 우선순위가 동일한 채권자 그룹을 ‘부당하게 차별하지’ 않아야 한다. 파산의 일환으로 공무원 연금이 삭감될 가능성을 높이면 공무원들은 보다 현실적인 혜택 약속을 수락한 이후, 다음에 구성될 주 정부에 적절한 자금을 제공하도록 압력을 가할 수 있다. 따라서 파산의 위협과 그로 인한 공동의 고통은 채권자와 공무원 모두가 공공 재정의 지속 가능성을 추구하도록 독려할 것이다. 또한 법원은 그러한 계획이 경제적으로 실현 가능해야한다는 요구 사항을 엄격하게 적용할 것이다. 즉, 계획은 단기적 구제뿐만 아니라 장기적인 지속 가능성을 약속해야한다는 의미이다.

다섯째, 제9조가 각 주를 수용하기 위해 개정될 때, 선임되는 판사는 이해의 상충을 최소화하는 방식으로 임명될 것이다.

미국 전역에는 약 90개의 파산 신청 지역이 있으며, 각 지역마다 자체 판사 제도를 두고 있다. 파산 법원에서 일반적으로 자체 서기관들을 보유하고 있다. 일반 파산의 경우. 판사는 서기관들에 의해 무작위 방식으로 배정된다. 그러나 제9조의 경우, 판사는 무작위로 선정되지 않는다. 대신, 미국 항소법원(Court of Appeals)의 수석이 사건이 발생한 파산 법원의 판사를 배정한다. 그러나 파산 판사는 이러한 파산과 이해관계가 있는 공무원과 동일한 공동체에 거주해야하므로 판사가 공무원보다 채권자(각 주)를 선호하는 개인적 동기가 부여될 수 있다. 이에 대한 대안으로 다른 주의 판사 중에서 파산 판사를 임명하거나 90개 지구 중 어느 곳에서든 무작위로 판사를 선임하는 방식이 있다. 독립적으로 판단할 수 있는 판사를 유지할 수 없다면, 주 파산이 목표를 달성하지 못할 수 있다.

* *

References List :

1. Mercatus Center Policy Briefs. June 11, 2020. Veronique de Rugy & Todd Zywicki. The Difficult Path to State Bankruptcy.

https://www.mercatus.org/publications/covid-19-economic-recovery/difficult-path-state-bankruptcy

2. April 15, 2020. Trend Editors. An Extraordinary Opportunity to Fix America’s Pension Crisis.

https://audiotech.com/trends-magazine/an-extraordinary-opportunity-to-fix-americas-pension-crisis/

3. CHICAGO TRIBUNE. MAR 30, 2020. MARK GLENNON. Commentary: Pension bailouts are not the answer for Chicago and Illinois — even during a pandemic.

https://www.chicagotribune.com/opinion/commentary/ct-opinion-coronavirus-pensions-bailouts-20200330-72mzxrkerrfgfmsbuars6vkbga-story.html

4. Apr 28, 2020. Elizabeth Bauer. Pension Bailout Or Bankruptcy? That’s Missing The Bigger Picture.

https://www.forbes.com/sites/ebauer/2020/04/28/pension-bailout-or-bankruptcy-thats-missing-the-bigger-picture/#2645d05d14ed

5. The New York Time. April 17, 2020. Mary Williams Walsh. Illinois Seeks a Bailout From Congress for Pensions and Cities.

https://www.nytimes.com/2020/04/17/business/dealbook/illinois-pension-coronavirus.html

6. Wall Street Journal. April 24, 2020. Andrew Biggs. A Bailout for Illinois? Not Without Strict Conditions.

https://www.wsj.com/articles/a-bailout-for-illinois-not-without-strict-conditions-11587765373

7. Illinois Policy. August 13, 2019. Adam Schuster. Nearly 40% of Education Spending Consumed by Pension Costs.

https://www.illinoispolicy.org/nearly-40-of-education-spending-consumed-by-pension-costs/

8. Illinois Policy. August 13, 2019. Adam Schuster. WHY CONGRESS SHOULD REJECT ILLINOIS’ $44 BILLION BAILOUT REQUEST.

https://www.illinoispolicy.org/why-congress-should-reject-illinois-44-billion-bailout-request/

9. Yankee Institute for Public Policy. April 23, 2020. Mark E. Fitch. Bailout or bankruptcy for states? Connecticut faces long-term “structural imbalance.”

https://yankeeinstitute.org/2020/04/23/bailout-or-bankruptcy-for-states-connecticut-faces-long-term-structural-imbalance/

10. com April 30, 2020.Pamela Boykoff. Debate emerges: Should businesses be protected from Covid-19 lawsuits?

https://edition.cnn.com/2020/04/29/business/business-liability-congress/index.html

11. Financial Times. APRIL 22, 2020.Andrew Edgecliffe-Johnson & Lauren Fedor.US business groups seek protection from coronavirus lawsuits.

https://www.ft.com/content/1ae66ded-7154-4881-ae9b-d9583e7e4676

12. com. May 1, 2020. Marisa Schultz. GOP leaders draw red line on next phase of coronavirus aid legislation.

https://www.foxnews.com/politics/gop-leaders-draw-red-line-on-next-phase-of-coronavirus-aid-legislation

|  |

A growing number of governors are voicing concern about the damage inflicted on both the revenue and the expenditure sides of their states’ budgets by the COVID-19 pandemic. To allay these concerns, the $2 trillion Coronavirus Aid, Relief, and Economic Security (or CARES) Act provided $150 billion to state and local governments in addition to a $30 billion education fund, a $45 billion disaster relief fund, and other smaller programs. But even these massive sums are proving inadequate to prevent the enormous disruptions caused by large-scale business shut-downs, plummeting tax revenues, and new healthcare and unemployment insurance expenses. Moreover, this threat only grows with each day that states like New York, New Jersey, Illinois, and California delay fully reopening for business.

The situation is particularly dire for the many states that entered the current crisis with “preexisting conditions” that render them less able to cope with these challenges owing to repeated failures in addressing their budget issues. That’s especially true for states with heavily underfunded public employee retirement benefits. Many states that have offered generous retirement benefits to their employees have not funded these benefits in full, partly because the needed money has been spent elsewhere in the budget. Accounting gimmicks, as well as high investment returns in the past decade, have kept overburdened states afloat. But just as economic catastrophe is driving debt-laden companies such as JC Penney, Neiman Marcus, and Hertz into bankruptcy, many states are being forced to confront similar burdens.

It is in this context that the idea of including states under Chapter 9 of the U.S. bankruptcy code, which allows cities, counties, and other municipalities to file for bankruptcy, has resurfaced. This proposed expansion would allow state governments to file for bankruptcy.

Although controversial, the idea of political jurisdictions filing for bankruptcy is far from radical. In fact, since 1980, there have been a total of fifty-four Chapter 9 filings involving cities, counties, towns, and villages.

In theory, allowing states to go through the bankruptcy process would overcome today’s political obstacles and finally create the conditions for financially troubled states to rectify their unsustainable financial conditions.

It this realistic? Consider the facts.

Ideally, insolvent states would try to right their fiscal conditions. That means legislatures and governors would make the hard budget adjustments necessary for states to meet their obligations to the public, retirees, and bondholders. But it is apparent, especially for the most financially overburdened states, that doing so is neither politically feasible nor economically possible without severe cuts to public services.

A decade ago, General Motors and Chrysler both descended into bankruptcy after decades of mismanagement and poor performance, as well as excessive labor and retiree costs. In a similar fashion, decades of mismanagement and short-term political decision-making by state governments have finally collided with economic reality. But today, states don’t have the option of “wiping the slate clean” via bankruptcy.

So, what options do states have? Their preferred option would be to get a federal bailout. But that would provide no incentives to reform overly generous public employee labor compensation, which is the root cause of their problems; such a bailout would only encourage states to continue making poor choices. It would also require residents of fiscally prudent states to bail out state which refuses to live within their means, many of which are wealthy. Alternatively, states, as sovereign entities, could simply default on their debts. But that would mean public employees are protected at the expense of taxpayers and bondholders. And this would make it unlikely that these states could borrow money at anything other than “junk bond rates,” ever again. Worst of all, current taxpayers in New York and Illinois would end up paying higher interest rates, getting fewer services, and funding public-sector retirees now living in Florida.

Until Senate Majority Leader McConnell made clear that no bailout would be forthcoming this year, the idea of states seeking bankruptcy protection was only a hypothetical suggestion. In fact, McConnell took the bold step of suggesting that expansion of Chapter 9 bankruptcy to include state governments was an attractive alternative which Congress should seriously consider as a means of alleviating the crisis many states now face. Naturally, this sent shock waves through states like Illinois, New York, and California with huge underfunded pension liabilities.

But in the absence of a Federal bailout, McConnell’s suggestion appears a better alternative than selective default and debt repudiation, which would create many new problems and do little to solve current problems. This is especially true since many of the most troubled states are constrained by state constitutional provisions that prohibit the flexible options that states should use to rectify their balance sheets in a comprehensive way. Most important, many state constitutions contain provisions that have been interpreted by courts to guarantee that state and local employees have a right to pension benefits based on the formula in effect at hire, without reduction, until retirement, essentially rendering these obligations untouchable.

The idea of extending bankruptcy to states is not new; in fact, Trends touched on this topic in the April 2020 issue. University of Pennsylvania law professor David Skeel, a specialist in corporate finance and bankruptcy, first introduced the idea after the Great Recession of 2007-to-2009. He argued that a procedure for bankruptcy could instantly reduce states’ unsustainable bond debt, cut wasteful spending, and allow states to rework unsustainable public employee retirement benefit obligations. Duke Law professor Steven Schwarcz even designed a model state bankruptcy law that would achieve these objectives.

What’s the bottom line? Extending bankruptcy mechanisms to the states would avoid some of the problems with the current alternatives. But Chapter 9 bankruptcy, as currently formulated, is no panacea for taming countervailing political dynamics. The more recent bankruptcy experiences of larger and more indebted municipalities like Detroit have exposed the difficulties of keeping the process free of politics. Furthermore, in order to avoid some of the problems that have arisen in municipal bankruptcies, it appears that commonsense reforms will need to be made before making states eligible for bankruptcy.

Given this trend, we offer the following forecasts for your consideration.

First, this will be an important fault line for the 2020 elections, even though it is unlikely that bankruptcy expansion or Federal bailouts will make it into the Phase Four COVID19 relief act.

Democrats have already endorsed state bailouts as part of the so-called HEROES Act. However, few pivotal states in terms of winning control of the Senate or achieving electoral college victory would benefit from this bailout. Furthermore, in many House districts, public employees are increasingly being perceived as “overpaid parasites” by the broader electorate. Meanwhile, voters will watch as, slow-to-reopen blue states like Illinois, New York, New Jersey, and California teeter-on-the-brink, while red states like Missouri, Florida, Georgia, and Texas return to stable growth. —Unless something disrupts this pattern before November, it will be a political plus for Republicans and political minus for Democrats.

Second, assuming Republicans win back control of the House and retain the Presidency and Senate, bankruptcy will become available to state governments.

To avoid pitfalls, this legislation must be carefully crafted taking into account the unique political and constitutional aspects of the situations. For example, under America’s system of constitutional federalism, states as sovereign entities would retain the option to repudiate their debts in whole or in part, subject to their own laws. And, unlike Chapter 11 corporate bankruptcy, Chapter 9 provides no option for creditors to initiate involuntary bankruptcy proceedings. But, giving states the option to file for bankruptcy would not only provide them with a workable alternative to outright default, but it could also give them leverage in reaching consensual adjustments without ever having to resort to an actual bankruptcy filing.

Third, opening-up the bankruptcy alternative to states will allow them to side-step ill-conceived state laws.

Under the Supremacy Clause of the U.S. Constitution, Federal bankruptcy law overrides state constitutional constraints letting the court adjust earned and unearned pension benefits of existing workers and current retirees. On paper, bankruptcy preserves the property rights for vested benefits but allows the reworking of all contractual promises, including public employee pension contracts.

Fourth, bankruptcy law rigorously enforced will ensure that all creditors are treated equally and will create incentives to avoid unsustainable future commitments.

Requiring all claimants to share equally in the pain of bankruptcy and demanding that the plan be “economically feasible” is not only fair, it also creates positive incentives for all parties by restraining "moral hazard" and creating incentives to hold state governments accountable. Chapter 9, like Chapter 11, requires that any reorganization plan not “unfairly discriminate” among different groups of creditors that hold the same priority. Raising the possibility that public employee pensions would be subject to cuts as part of bankruptcy would create powerful incentives for public employees to accept more realistic benefit promises and then to pressure state governments to fund them adequately. Thus, the threat of bankruptcy and the shared pain it could bring about would provide incentives for both bondholders and public employees to pursue greater public fiscal sustainability going forward. Courts would also rigorously apply the requirement that any plan should be economically feasible, meaning that the plan must promise long-term sustainability, not just short-term relief. Therefore, failure to clearly address looming, underfunded retirement obligations would render any proposed plan infeasible. And,

Fifth, when Chapter 9 is amended to accommodate states, judges will be appointed in such a way as to minimize conflicts of interest.

There are about 90 bankruptcy districts across the United States, and each one has its own judge. The bankruptcy courts generally have their own clerk’s offices. In a regular bankruptcy case, the judge is selected at random by the clerk of the court. However, in Chapter 9 proceedings, the judge is not chosen at random. Instead, the chief judge of the U.S. Court of Appeals chooses a judge from the bankruptcy court where the case is located. But since those bankruptcy judges have to live in the same community as the public employees whose benefits are on the chopping block, this creates personal incentives for the judge to favor public employees over bondholders. Alternatives include appointing a judge from another state or appointing a judge at random from any of the 90 districts. The stakes are high and failing to keep the judge independent would all but assure that state bankruptcy will fail to achieve its goals and that state debt problems and political obstacles in the path of their resolution will persist.

References

1. Mercatus Center Policy Briefs. June 11, 2020. Veronique de Rugy & Todd Zywicki. The Difficult Path to State Bankruptcy.

https://www.mercatus.org/publications/covid-19-economic-recovery/difficult-path-state-bankruptcy

2. April 15, 2020. Trend Editors. An Extraordinary Opportunity to Fix America’s Pension Crisis.

https://audiotech.com/trends-magazine/an-extraordinary-opportunity-to-fix-americas-pension-crisis/

3. CHICAGO TRIBUNE. MAR 30, 2020. MARK GLENNON. Commentary: Pension bailouts are not the answer for Chicago and Illinois — even during a pandemic.

https://www.chicagotribune.com/opinion/commentary/ct-opinion-coronavirus-pensions-bailouts-20200330-72mzxrkerrfgfmsbuars6vkbga-story.html

4. Apr 28, 2020. Elizabeth Bauer. Pension Bailout Or Bankruptcy? That’s Missing The Bigger Picture.

https://www.forbes.com/sites/ebauer/2020/04/28/pension-bailout-or-bankruptcy-thats-missing-the-bigger-picture/#2645d05d14ed

5. The New York Time. April 17, 2020. Mary Williams Walsh. Illinois Seeks a Bailout From Congress for Pensions and Cities.

https://www.nytimes.com/2020/04/17/business/dealbook/illinois-pension-coronavirus.html

6. Wall Street Journal. April 24, 2020. Andrew Biggs. A Bailout for Illinois? Not Without Strict Conditions.

https://www.wsj.com/articles/a-bailout-for-illinois-not-without-strict-conditions-11587765373

7. Illinois Policy. August 13, 2019. Adam Schuster. Nearly 40% of Education Spending Consumed by Pension Costs.

https://www.illinoispolicy.org/nearly-40-of-education-spending-consumed-by-pension-costs/

8. Illinois Policy. August 13, 2019. Adam Schuster. WHY CONGRESS SHOULD REJECT ILLINOIS’ $44 BILLION BAILOUT REQUEST.

https://www.illinoispolicy.org/why-congress-should-reject-illinois-44-billion-bailout-request/

9. Yankee Institute for Public Policy. April 23, 2020. Mark E. Fitch. Bailout or bankruptcy for states? Connecticut faces long-term “structural imbalance.”

https://yankeeinstitute.org/2020/04/23/bailout-or-bankruptcy-for-states-connecticut-faces-long-term-structural-imbalance/

10. com April 30, 2020.Pamela Boykoff. Debate emerges: Should businesses be protected from Covid-19 lawsuits?

https://edition.cnn.com/2020/04/29/business/business-liability-congress/index.html

11. Financial Times. APRIL 22, 2020.Andrew Edgecliffe-Johnson & Lauren Fedor.US business groups seek protection from coronavirus lawsuits.

https://www.ft.com/content/1ae66ded-7154-4881-ae9b-d9583e7e4676

12. com. May 1, 2020. Marisa Schultz. GOP leaders draw red line on next phase of coronavirus aid legislation.

https://www.foxnews.com/politics/gop-leaders-draw-red-line-on-next-phase-of-coronavirus-aid-legislation